In July 2025, President Donald J. Trump announced "a strategic realignment of the US-Japan economic relationship,” including a Japanese commitment to invest $550 billion to “rebuild and expand core American industries” in projects to be approved by Trump himself. In November at the White House, President Trump got Mohammed bin Salman, the crown prince of Saudi Arabia, to pledge “almost $1 trillion” in investment commitments in the United States.

Altogether, the Trump administration’s so-called America First Investment Policy with various trading partners—including the European Union, the Gulf Cooperation Council countries (including Saudi Arabia), South Korea, Switzerland, and Taiwan—totals more than $5 trillion in investment commitments tied to US industry, infrastructure, and supply chains.[1]

How realistic are these commitments? The short answer is that they are clouded with uncertainty.

In a newly published Policy Brief from the Peterson Institute for International Economics, we examine the implications of Trump’s “America First” approach to commercial and trade relationships. We conclude that the deals suffer from a lack of clarity on the investment timing and investment decision-making process, raising doubts in some cases over the politicization of investment decisions, and whether the countries making the commitment have the resources or determination to fulfill them or to stand by them, especially given that they made their pledges in an atmosphere of threats.

We also argue that, through these deals, the US administration has shifted toward a more transactional, extractive form of diplomacy and embarked on a dramatic expansion of US industrial policy—one financed largely by allies rather than US taxpayers. This government-driven investment strategy circumvents some of the powers of the US Congress. For example, instead of seeking appropriations, the administration is directing foreign governments to bankroll projects aligned with its priorities.

To be sure, the United States could gain from these deals in terms of growth, jobs, and the security of critical supply chains. However, there are also potential costs. The coercive nature of these deals risks alienating allies. Already the deal with the European Union has been thrown into uncertainty because of its vehement rejection of Trump’s designs on Greenland. It is also important to remember that industrial policies often fail. They raise the specters of corruption, government waste, and distorted economic incentives.

Incredible numbers

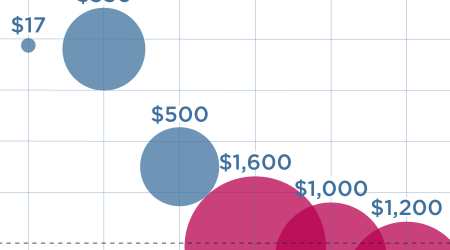

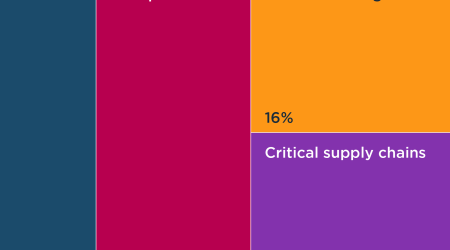

Even if they are spread over many years, some pledges amount to large shares of partner countries’ GDP. For Japan, South Korea, Switzerland, and Taiwan the numbers may be achievable through a reallocation of existing foreign investment flows, financial guarantees, and pressure on institutional investors. For several Gulf Cooperation Council countries (e.g., Saudi Arabia, Qatar, and the United Arab Emirates), however, the commitments, nearly $4 trillion in total, strain credibility. Achieving them would require large shifts in balance of payments positions or increased borrowing, at a time when their domestic development plans already call for large capital investment.

Across partners, the announced commitments vary widely in their structure and enforceability. Some pledges stretch over four years; others over a decade; others with no explicit time horizon at all. Some combine investment with military procurement, joint ventures, and/or commitments to buy US goods. Most lack a clear framework for monitoring and verification. Legally, most arrangements fall short of binding treaties but impose serious procedural commitments on partners.

Coercion by another name

The America First investment agenda marks a shift toward a more coercive approach to trade and investment relations with US allies. It also blurs the line between economic policy and security policy, particularly where defense procurement and technology controls are bundled into ostensibly commercial agreements.

Although the US administration claims these deals are mutually beneficial, many were negotiated under the threat of tariffs. There were also concerns that the US would withdraw its security umbrella. Tariff relief is often an explicit quid pro quo for cooperation, reinforcing the transactional nature of US relations with allies. On the US side, its ongoing negotiations will be complicated by legal challenges on tariffs before the US Supreme Court.

Industrial policy—with outsourced financing

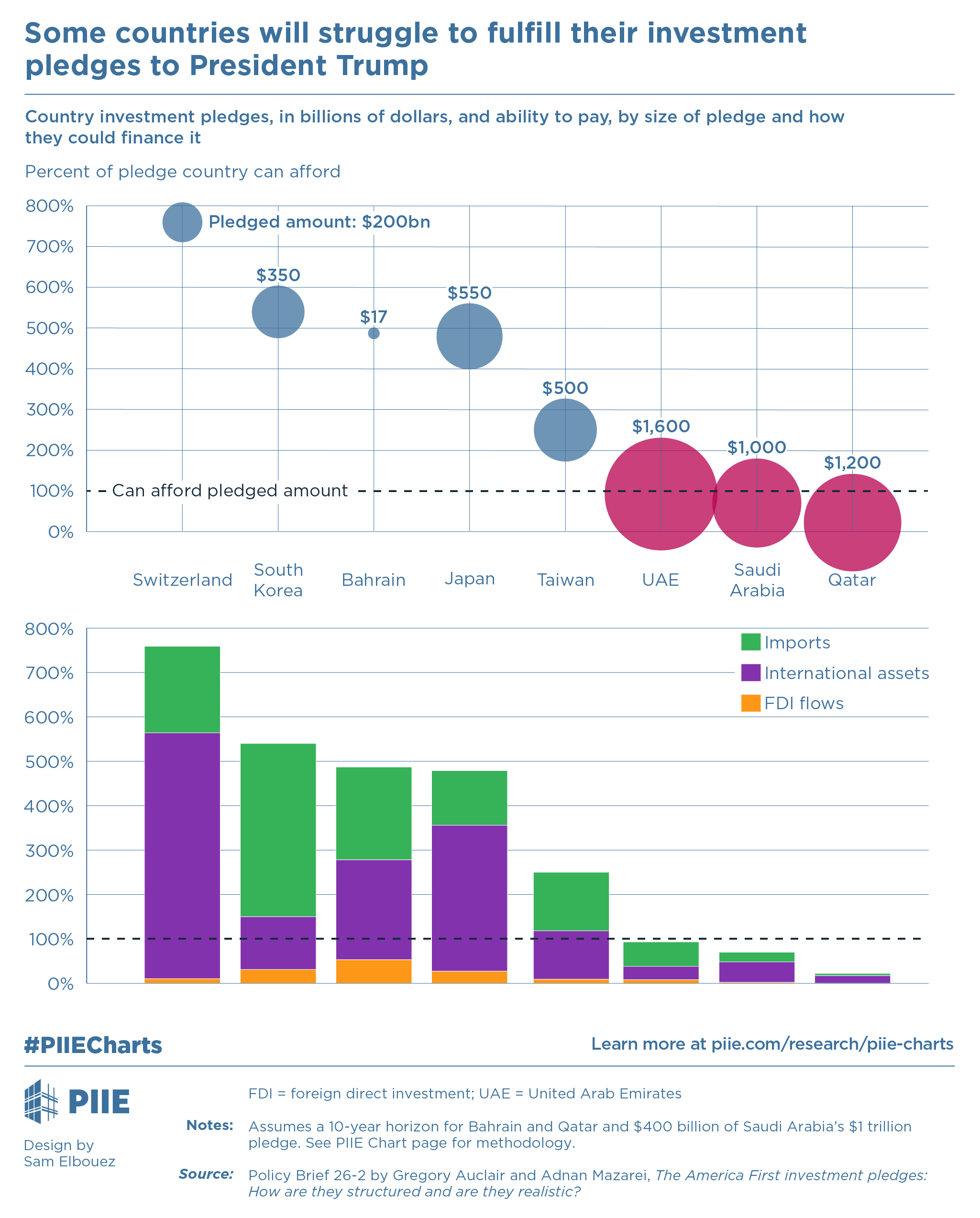

In terms of sectors, the pledges concentrate on areas that the administration views as strategic: energy infrastructure, defense and aerospace, shipbuilding, advanced manufacturing, artificial intelligence, and critical supply chains. The overlap with Biden-era priorities is notable, with one major exception. Where the previous administration emphasized clean energy, the current one has pivoted toward fossil fuels.

A sharper difference lies in the financing of these policies. Biden-era industrial policy relied on public spending, subsidies, and tax incentives. The Trump administration seeks to externalize much of the cost by directing allied capital toward US priorities. This approach may yield real investments and jobs, but it raises familiar industrial policy concerns: opaque project selection, weak accountability, and the risk that political criteria crowd out economic efficiency.

What to watch for?

Durable gains from the America First investment pledges are possible. But this depends on whether and when the pledges materialize, what projects are selected, and how they are governed. The Supreme Court could weaken the Trump administration’s hand on tariffs, making it harder to enforce the pledges. We also have to monitor how geopolitical tensions and heightened investment screening affect the overall investment environment in the United States. Furthermore, there will be macroeconomic spillovers from large capital inflows, such as the exchange rate of the US dollar.

Congress and the Senate should play some role. Without greater transparency, oversight, and clear objectives, these very large numbers risk leading to disappointing results.

With its America First policy, the US may be able to position itself better in its competition with China. But in pursuing an extractive, pay-for-protection scheme, the US could weaken its long-term relations with allies and encourage them to band together against it, a trend that has only accelerated in the wake of Greenland.

Note

1. The White House investment tracker, which records both private and official investments, shows a total figure of $9.6 trillion. In a recent briefing, President Trump used a figure of $18 trillion; the basis for his claim is not clear.

Data Disclosure

This publication does not include a replication package.