Former president Donald Trump is campaigning for reelection on promises that Americans’ lives would improve greatly if he wins a second term. “Under my plan, incomes will skyrocket, inflation will vanish completely, jobs will come roaring back, and the middle class will prosper like never, ever before,” he told the Republican convention in July.

Several of the policies he is promoting, however, would have the opposite effects, according to research detailed in our new PIIE Working Paper, “The International Economic Implications of a Second Trump Presidency,” and summarized here.

Among those measures are the deportation of millions of people from the United States, steeper tariffs, and the erosion of the Federal Reserve’s political independence.

We find that these steps would result in lower US national income, lower employment, and higher inflation than otherwise. In some cases, economic conditions recover over time, but in others the damage continues through 2040.

And despite Trump’s “America first” rhetoric, these policies would harm the US economy more than any other in the world, particularly trade-exposed sectors such as manufacturing and agriculture. In some cases, other countries would enjoy stronger economic growth than otherwise after receiving inflows of capital leaving the United States.

Policies Analyzed

We chose to analyze three sets of possible future Trump policies because of their potentially significant US and international economic implications:

- Deporting 1.3 million or 8.3 million unauthorized immigrant workers.

- Increasing tariffs on all US imports by 10 percentage points and boosting tariffs on US imports from China by 60 percentage points, with or without other countries retaliating by imposing higher tariffs on their imports from the United States.

- Increasing the president’s influence over the Fed.

We examine each policy’s effects separately using an economic model, detailed in our paper, to generate a baseline forecast for different variables in 24 countries and regions if these Trump policies are not adopted. Then, we use the model to project the effects of the policies, measured as deviations from each baseline.

The US baseline shows that on average from 2025 to 2040 the country will see annual real GDP growth of 1.9 percent; annual employment growth (measured as hours worked) of 1.5 percent; and an annual inflation rate of 1.9 percent. The US baseline assumes that the 2017 tax cuts enacted in Trump’s first term are extended or that some equivalent Democratic tax package is enacted: Otherwise their scheduled expiration in 2025 would impose a strong fiscal drag that would make the overall US results more negative. Because we assume the tax cuts are extended in both the baseline and counterfactual policy scenarios, the decision has almost no effect on the results when expressed as deviations from baseline. Our online dashboard provides a full set of macroeconomic and sectoral results for all countries.

We have no partisan goal in publishing this research. Our concerns are about the policies, not the candidate. Our objective is to educate policymakers and the public about the effects these measures would have on the US and other economies.

Combined Policy Effects

We also examined two combination scenarios to show what would happen if Trump implemented some of these policies together. In the “low” combination scenario, both the 10 and 60 percentage point increases in tariffs are imposed, foreign countries do not retaliate, 1.3 million workers are deported, and the Fed’s independence is eroded. In the “high” combination scenario, the same tariff increases are enacted, other countries retaliate, 8.3 million workers are deported, and the Fed’s independence is eroded.

Both of these scenarios cause a large inflationary impulse and significant declines in US employment, particularly in durable manufacturing and agriculture. They differ mainly by the magnitude of damage inflicted on households, firms, and the overall economy. Using them to create a range of outcomes if Trump’s policies are enacted, we find:

- US real GDP will be between 2.8 and 9.7 percent lower than baseline by the end of Trump’s four-year term in 2028. GDP recovers a bit thereafter but remains lower through 2040 (figure 1).

- Employment, measured as hours worked, increases at first but then falls and remains lower through 2040 than otherwise (figure 2). Employment rises between 1.5 and 1.8 percent above baseline in 2025, but it is between 2.7 and 9 percent below baseline by 2028. It stays between 0.4 and 3.4 percent lower by 2040.

- The US inflation rate climbs to between 4.1 and 7.4 percentage points higher than otherwise by 2026. That means, on top of baseline inflation of 1.9 percent, inflation peaks then at between 6 and 9.3 percent. By 2028, US consumer prices generally are between 20 and 28 percent higher. The inflation rate settles at 2 percentage points above baseline, or almost 4 percent, from 2034 through 2040 (figure 3).

Taken separately, the individual policies have similar generally negative economic effects, though of different magnitudes. The measures work through different channels and ripple around the world differently.

Impact of Mass Deportations

Trump has repeatedly vowed to carry out the “largest domestic deportation operation in American history,” targeting what he says are the 15 million to 20 million unauthorized immigrants in the United States, approximately 8.3 million of whom are estimated to be in the workforce.

The goal is endorsed in the Republican Party platform. Trump plans to model this effort after “Operation Wetback”—a 1956 campaign under the Eisenhower administration that deported 1.3 million people.

The two scenarios we examined—deporting 1.3 million or 8.3 million unauthorized immigrant workers—both cause lower US employment and real GDP through 2040 than otherwise. They also push US inflation higher through 2028.

The deportations would shrink the economy largely by reducing the number of potential workers and their demand for goods and services. This is consistent with research by Michael Clemens’ finding that immigrants create jobs for other workers. Removing immigrants reduces jobs for those remaining workers.

The potential US labor force would decline from the baseline by either 0.8 percent or 5.1 percent in 2028 depending on the program. This labor supply shock would cause employment (hours worked) to decline by either 1.1 percent or 6.7 percent, respectively, from baseline in 2028 (figure 4).

Losing so many workers increases costs in the sectors directly affected. It also causes a fall in the return on capital in each sector (notably agriculture), reducing investment across the economy, adding to the contraction in output.

US real GDP declines from baseline by 1.2 or 7.4 percent by 2028 but has little effect on the economic output or employment of other countries. The negative effect on other countries of a decline in US demand for exports from these countries is offset by the stimulus in other countries from the relocation of capital from the US to these economies.

Given annual baseline GDP growth of 1.9 percent, deporting 8.3 million workers implies that the level, or dollar value, of US GDP in 2028 will be almost unchanged from that in 2024—meaning no US net economic growth occurs over the second Trump term because of this policy alone.

Impact of Tariff Hikes

Trump is campaigning on what he has described as an “America first trade platform that takes [a] sledgehammer to globalism,” vowing to end reliance on China, create millions of new jobs, and grow GDP through higher tariffs and import restrictions.

Both of Trump’s tariff plans we examined—imposing 10 percentage point additional tariffs on US imports from all sources and 60 percentage point additional tariffs on imports from China—reduce US real GDP and employment by 2028. But the former proposal hurts the US economy more than the latter. The damage is magnified if other countries retaliate with higher tariffs on their imports from the United States.

Assuming other governments respond in kind, Trump’s 10 percentage point increase results in US real GDP that is 0.9 percent lower than otherwise by 2026, and US inflation rises 1.3 percentage points above baseline in 2025.

If China retaliates, Trump’s 60 percentage point hike leads to US real GDP falling more than 0.2 percent below baseline by 2026, and US inflation climbs 0.7 percentage points above baseline in 2025.

The US effects vary by sector, with durable manufacturing taking the biggest hits—the opposite of Trump’s stated goals.

The 10 percentage point added tariffs damage the economies of Canada, China, Germany, Japan, and Mexico—all major US trading partners that see lower GDP relative to their baselines through 2040. Mexico and Canada take much bigger GDP hits than the United States.

The 60 percentage point tariffs on imports from China lower its GDP, relative to its baseline, much more than that of other US trading partners. Mexico, however, sees higher GDP than otherwise as some production shifts there from China.

Impact of Eroding Fed Independence

While the Fed’s independence is not an international economic policy per se, its erosion could result in significant cross-border macroeconomic spillovers.The concern is that the president would press the US central bank to set interest rates lower than otherwise to spur stronger economic growth despite the likelihood of driving inflation higher.

Trump hasn’t specified how he might try to gain influence over the Fed’s monetary policy, but we assume he does and successfully presses it to rev up US economic growth. The results include lower US real GDP and significantly higher inflation than baseline through 2040.

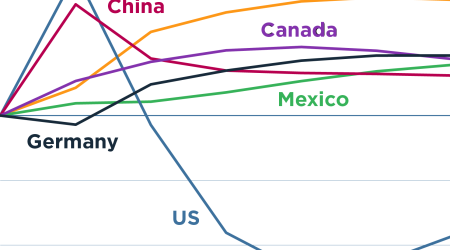

From 2026 on, capital flows out of the United States and into other countries, causing GDP to grow faster than baseline in China, Canada, Germany, Japan, and Mexico (figure 5). US employment surges initially, falls sharply through 2028, and then recovers to slightly above baseline through 2040.

We implement the erosion of Fed independence by assuming it causes two shocks to the financial system. In the first, central bank officials seek to spur the US GDP growth rate to 2 percentage points above potential—the fastest pace it can sustain without fueling higher inflation. This drives the inflation rate to spike initially before settling at roughly 2 percentage points above baseline.

We calibrate this by drawing on research by Ana Garriga and Cesar Rodriguez (2020), who found that central bank independence lowers inflation rates in developing economies by between 1 and 6 percentage points. The 2 percentage point increase is a conservative estimate.

In the second shock, the Fed’s new tolerance for hotter inflation raises the risk of investing in the US economy, causing the risk premium on holding US assets relative to those of other countries to rise by 2 percentage points. The size of the change in the risk premium is arbitrary, but it provides a plausible benchmark to assess the implications of a significant institutional change in the US economy.

Once global investors comprehend the Fed’s loss of independence, risk premia rise, likely prompting capital outflows from the US economy. This eventually translates into a fall in physical investment, reducing potential GDP over time.

The capital leaving the United States flows into other economies, lowering long-term real interest rates in these countries and increasing investment. Production shifts from the United States to the rest of the world, given the additional cost of investing in the United States. As a result, from 2026, GDP rises above the baselines in China, Canada, Germany, Japan, and Mexico.

The US trade deficit shrinks by over 5 percent of GDP in 2025 because the dollar depreciates and US imports fall in the slowing economy.

Fed officials’ more stimulative monetary policies initially boost US real GDP higher than otherwise in 2025 but can’t keep it from falling below baseline thereafter.

The US inflation rate rises to 2.8 percentage points above baseline in 2025 and 3.2 percentage points above in 2026. If baseline inflation is 1.9 percent, the rate peaks in 2026 at 4.1 percent. The rate then declines over time to settle at 2 percentage points above baseline through 2040.

Conclusion

Donald Trump portrays the United States as the victim of perfidious foreigners. He proposes to right the scales through policies of mass deportations, trade protection, and influence over the Fed. We find that, on the contrary, these policies over time would leave the US economy generally worse off than if he did not enact them. They would particularly hurt manufacturing and agriculture.

Trump often promises to “make the foreigners pay,” but under these measures American households and firms would suffer the most.

Data Disclosure

This publication does not include a replication package.

Special Project