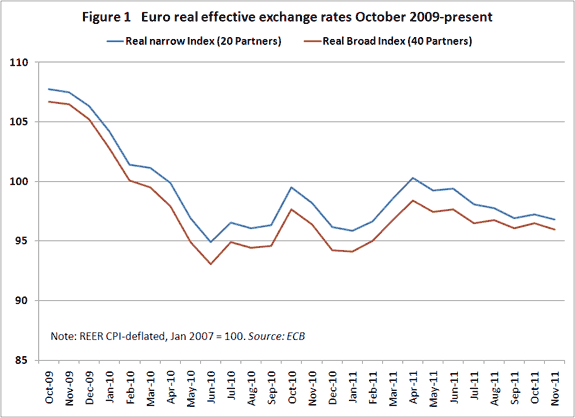

As the most anxious year in the history of the euro draws to a close, and with dire predictions about the euro's fate in 2012, it is an irresistible option for this author to take stock in a more realistic way. Despite all this year's drama, the value of the euro is almost exactly where it was at the beginning of 2011. Indeed it seems 2011 and its attendant turmoil might just as well not have happened. It was certainly no annus horribilis for the value of Europe's currency. As Figure 1 shows, the real effective euro exchange rate today is above what it was in May–June 2010, when the crisis was only about Greece, and even slightly above what it was when the crisis spread to Ireland and Portugal in late 2010. After the prolonged decline in the real trade weighted value of euro1 following the revelation of the fraudulent Greek fiscal data in October 2009, it is almost as if investors actually stopped worrying, as it became clear by May–June 2010 that in the euro area (like everywhere else) the bailout that some doubted did happen.

Remarkably, the large increases in interest costs for systemically important and arguably too-big-to-bail-out Italy and Spain in July and August 2011 had next to no impact on the value of the euro. The common currency merely continued the slow decline that started several months earlier. Causality is always dangerous to allege. But Figure 1 suggests that the acknowledgement in April by the German finance minister, Wolfgang Schäuble, that Greece needed to restructure its government debts, with losses imposed on the private creditors of an Organization for Economic Cooperation and Development (OECD) country for the first time in decades, was more important than the rise of Italy's borrowing costs to levels that would be unsustainable if maintained over many years. That "broken taboo" against debt write-downs, and the fear that it might spread to other euro area countries, stressed the euro more than Italy's temporary funding costs and indeed more than anything else in 2011.

The European Central Bank (ECB) and others that had warned against that haircut, known as the Private Sector Involvement (PSI), were proven right about its immediate contagious effects. This was true even though Greece's debt sustainability required substantial debt write-downs. Although the likely imminent implementation of PSI provides political cover for continued official sector (especially euro area) financial support for Greece, euro area leaders must now convince markets that it will not be repeated. As European Council President Herman van Rumpoy said in the early morning of December 9: "Our first approach to PSI, which had a very negative effect on the debt markets, is now officially over."

When you are in a hole, the cliché goes, it advisable to stop digging. But at least some shoveling by euro area leaders during 2011 will continue into 2012. That does not mean that no political response was undertaken this year. The main problem was one of policy coordination and sequencing for different parts of the responses.

The euro area crisis is multifaceted. It encompasses a fiscal crisis (Greece), a competitiveness crisis (the Southern periphery), a banking crisis (Ireland, Spain, Germany, and others), and a design crisis (the flawed initial design of euro area institutions). Coordinating these elements is critical. Too much austerity to deal with a fiscal crisis will depress economic growth, which might itself depress government revenues, although this is disputed by the ECB and the European Commission's doctrinal oxymoron of "expansionary consolidation." The ECB president, Mario Draghi, at least made a welcome admission that there was a fallacy at work when he said in a recent Financial Times interview that "I would not dispute that fiscal consolidation leads to a contraction in the short run."

Policy coordination can be extremely difficult within a single government's multiple political and administrative organs. The difficulties multiply among 17 or 27 countries with their own democratic processes. The biggest policy coordination obstacle in the euro area stems from its flawed initial institutional design, and its lack of critical common fiscal and banking regulatory institutions to help cope with the global financial crisis. The United States in late 2008 and early 2009 was hobbled by turf wars and legal constraints among the US Treasury, the Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC). Euro area policymakers faced the infinitely harder challenge of coordinating among institutions that had to be created, staffed, funded, and given a democratic and legal mandate involving 17 or 27 members. Coordination between the embryonic European Financial Stability Facility/European Stability Mechanism (EFSF/ESM) on the one hand and the ECB on the other is infinitely harder, especially when no one knows what the role of the EFSF/ESM will ultimately be. The ECB, meanwhile, is clearly trying to force governments to grant it a large mandate and large amount of funding. In this uncertain policy environment, financial markets can quickly lose confidence.

It is in the overlap between the euro area fiscal and banking crises that the lack of policy coordination has had the most devastating effect. Most euro members have banks that are not only too big to fail (TBTF), but possibly, as in Ireland, too big for national governments to rescue. At the same time, banks own a lot of government debt, so the linkages are symbiotic. In this situation, large and immediate spillovers between the sovereign/fiscal and banking crises are unavoidable, and close policy coordination is imperative. Obviously, euro area leaders failed abysmally in this task during 2011.

Wolfgang Schäuble, the German finance minister, may have articulated the obvious in April, when he said that Greece was insolvent and that it was not politically sustainable to transfer all these losses to the official sector. But raising this issue in a fairly open-ended manner at a time when euro area banks were severely undercapitalized and there was no credible financial backstop for most of them—something the expansion of the EFSF's lending options to include bank recapitalizations only achieved by July 21—was a clear example of policy coordination failure. The fact that the EFSF/ESM were not big enough to deal with Spain and Italy was a further source of uncertainty.

A similar failure occurred when euro area policymakers set up the European Banking Authority (EBA) and understandably demanded that undercapitalized European banks accelerate their recapitalization process and achieve a Core Tier 1 capital ratio of 9 percent in order to build up a temporary capital buffer against sovereign debt exposures to reflect current market prices. The problem was that the sudden mark-to-market accounting of all bank sovereign debt holdings, combined with the reliance on an increased capital ratio, resulted in substantial deleveraging and dumping of non-national government debt by various euro area banks. These one-off attempts to address the banking crisis have almost certainly had a strongly pro-cyclical effect and worsened the situation in sovereign debt markets and hence the euro area fiscal crisis.

Primum non nocere, first do no harm, is the starting point for all emergency medical assistance. It is an axiom that euro area policymakers must embrace in 2012, as the European ship sails toward an iceberg in the form of hundreds of billions bond rollovers for sovereigns and banks. Two heavy political issues also loom:

- Completion of the new Inter-Governmental Treaty on the new Euro Area Fiscal Compact. Up to 26 EU member governments have declared their interest in participating, although the final number of non-euro area members may be fewer than nine. Substantial political challenges will surround the implementation of the fiscal compact. Member states must amend their laws to incorporate the balanced budget principle and legislatures will have to approve the transfer of more fiscal sovereignty to the supra-national euro area level.

- Completion of the new European Stability Mechanism (ESM) Treaty; the revised treaty without a PSI is to come into force in June; it might be increased in size in March in accordance with the December 9 summit agreement.

Meanwhile in the banking system, capital deficient European banks are supposed to hand in their plans to national regulators to reach their 9 percent Core Tier 1 capital target on January 20, after which the aggressive deleveraging of risk weighted assets is expected to subside.

The ECB has already begun its substantive 2012 policy agenda with the first of two planned 3-year longer-term refinancing operations (LTROs) on December 21. The demand for this first unlimited offer of liquidity was €489 billion. The net increase in bank loans to 523 banks from the ECB was about €210 billion. The bank's loan offering thus suggests that there is now limited "stigma" attached to the reliance on ECB funding among European banks. The broad implication is that the risk of a euro area bank suddenly collapsing in 2012 has been reduced, especially since the banks have another opportunity to access ECB 3-year liquidity in late February.

How the banks plan to use this new long-term liquidity is not known. But the banks will have refinanced a lot of their existing maturing short-term debt with the new much longer-term loans, hopefully releasing capital for continued bank lending to euro area enterprises and easing the regional credit crunch. In a region where 80 percent of all credit is dispersed by banks, this should alleviate the risk of a deep recession.

Recent declines in interest rates for Spanish and Italian sovereign debt, especially for the shorter end of the yield curve—as well as comments by President Nicolas Sarkozy of France after the December 9 EU Summit—have suggested that banks will use some amount of the unlimited 1 percent ECB funding to purchase euro area sovereign debt. Given today's high Spanish and Italian yields, this would result in a potentially sizable "carry-trade profit" for the purchasing bank.

Such strategies by struggling banks could even amount to a meaningful backdoor recapitalization, locking in profitable high coupon payments from their governments. Italy and Spain would in turn benefit from not having to undertake the extremely unpopular process of directly recapitalizing their banks ahead of the June 2012 deadline for addressing more than €41 billion in shortfalls. One might also argue that the purchase of high yielding national sovereign debt by such banks would constitute a kind of national redistributive transfer from taxpayers footing the bill for elevated interest costs to shareholders and creditors of the banks. These bank stakeholders might or might not be domestic, but this transaction would fulfill the implicit state guarantee for Europe's TBTF banks.

The new ECB 3-year funding option might further ease the detrimental financial effects of a major policy omission this year, the failure to agree on a pan-European term funding guarantee scheme for bank debt backed by the EFSF. Such an agreement is crucial for the reopening of the stalled term unsecured inter-bank funding market. Without it, euro area banks will have to make do with a set of national term funding guarantees, which for Italy would hardly assure other banks as counterparties. On the other hand, national bank bond guarantees will almost certainly make such bank bonds eligible as ECB collateral, irrespective of what the bonds are backed by. Collateral status for the bonds would allow Italian banks to repo any loan guaranteed by a national government to obtain a three-year loan from the ECB. Such a stratagem would clear the way for the Italian government to help banks offload government guaranteed bonds with the ECB so they can purchase new bonds to be issued by the Italian government in 2012. This option could be especially appealing as the second ECB allotment of unlimited 3-year loans occurs at the end of February, at the peak rollover season in early 2012.

At their last conference call in 2011 , EU finance ministers agreed to make €150 billion available to the International Monetary Fund (IMF), helping to ensure that it has adequate resources to combat the global economic crisis. The United Kingdom has hedged its bets, and only committed to this effort in conjunction with broader global efforts supported by other major non-euro-area countries in the G-20. The challenge for euro area leaders (and IMF officials) will now be to ensure that sufficient parallel contributions will be forthcoming. Ideally, they must do so ahead of the next G-20 Finance Ministers and Central Bank Governors meeting in Mexico on February 25–26. Meeting that challenge will be difficult, despite the IMF's status as a safer "counterparty" than the unappealing EFSF leveraging option. It will not be easy, for example, to convince China and other surplus countries to make sizable financial contributions. Certainly, the euro area must show its willingness to be flexible on other policy fronts. Beyond the issue of their own over-representation on the IMF Board and in the organization's voting weight, Europeans must convince the rest of the world that they have done enough themselves to salvage the euro's future prospects.

How big must a new additional IMF-led program be to bolster confidence in the sovereign bond markets of Spain and Italy? Earlier estimates for the size of the firewall suggested that perhaps €1.5 trillion to 2 trillion was the minimum necessary. Europe has not been able to put together a single bazooka of such magnitude. But the EFSF/ESM will be €500bn in 2012, which would meet the funding needs of the three small IMF program countries for the foreseeable future. In addition, the ECB has bought €211 billion through the Securities Market Program and is providing another €489 billion that could be used by euro area banks to purchase shorter term government bond s. Add to that the earlier bilateral euro area loans provided to Greece, and the sum begins to approach about €800 billion to 900 billion committed to stabilizing the euro area.

On top of that comes the €150 billion in new capital pledged to the IMF, which with politically feasible leverage from other new IMF contributions might amount to another €600 billion. Added together, the entire committed official sector resources towards euro area stabilization in early 2012 come to roughly €1.5 trillion, plus the value contributed by the essentially unlimited ECB liquidity provisions to the euro area banking system.

This is not a neat and rapidly implemented "single barrel bazooka" for sure. On the other hand, the euro area is inherently much more complex than single government entities and this is not chump change. Combined with continued progress on fiscal consolidation and pro-growth structural reforms, the totals are enough to restore confidence gradually in the euro area sovereign debt markets in 2012 and return the common currency to the "good equilibrium" of sustainable refinancing costs for the large peripheral economies.

Credit rating agencies do not see a "euro area comprehensive solution" and consequently they may go ahead with widespread downgrades of euro area sovereigns. That, however, is largely irrelevant. A downgrade would add no new information to the marketplace aside from some alarmist headlines for a few days. The agencies' conduct merely underlines their limited ability to undertake the type of political economy analysis required for a highly complex hybrid entity like the euro area. A better approach for 2012 would be to quickly phase out the role of credit rating agency opinions in investment decisions embedded in various rules and regulations. Regrettably, though, an alternative would be hard to quickly come up with, as the banks' in-house risk-models, for instance, are hardly an improvement.

In sum, 2012 will undoubtedly be yet another volatile year for the euro. But crisis management will likely improve and the catastrophic tail-end events will gradually disappear from the minds of most.

The major political challenge for the euro area in 2012 will thus not be to address the immediate crisis, but rather the longer-term direction of institutional reform. During 2012, the euro area is likely to see a new and considerably more credible set of fiscal rules and budget oversight regulation. This has been a clear and understandable demand from the ECB and Germany. But while the new fiscal compact will undoubtedly help stabilize the euro area, it must not serve as the end of the institutional reforms needed by the region. The movement toward further and symmetrical deepening of euro area fiscal integration must be maintained. There should consequently also be concrete steps taken on a reasonable timetable toward the introduction of eurobonds.

Note

1. Bilateral exchange rate relationships like the $-€ are by definition affected by events in both countries, so that the euro might bilaterally weaken against the dollar because of chaos in the euro area or because of improved performance of the United States. Using trade-weighted (manufacturing goods) averages of the euro exchange rate against a number of trading partners instead captures how much foreign exchange can be acquired, on average, for €1. This approach more accurately captures the effects of euro area specific events vs. the rest of the world.