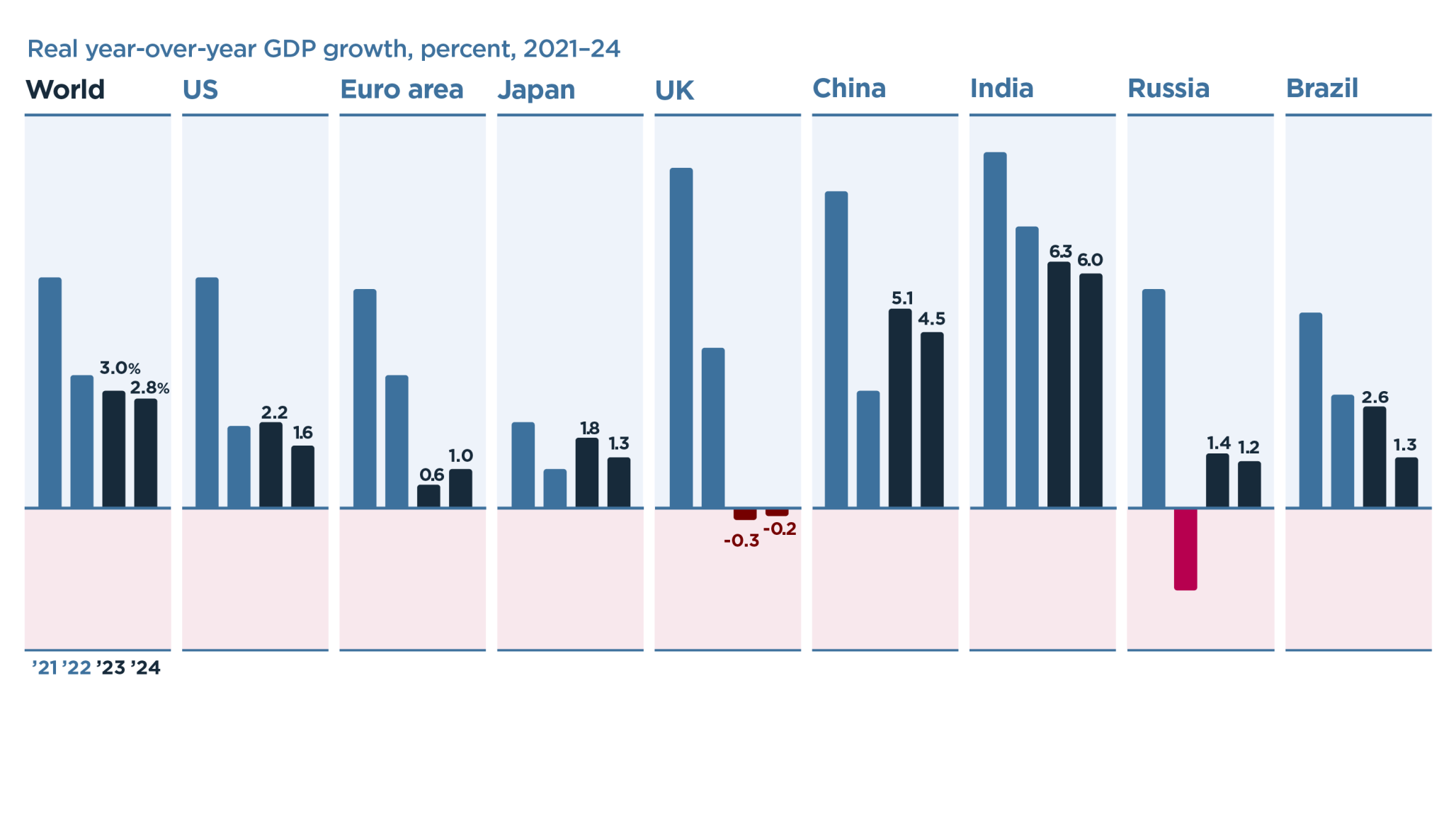

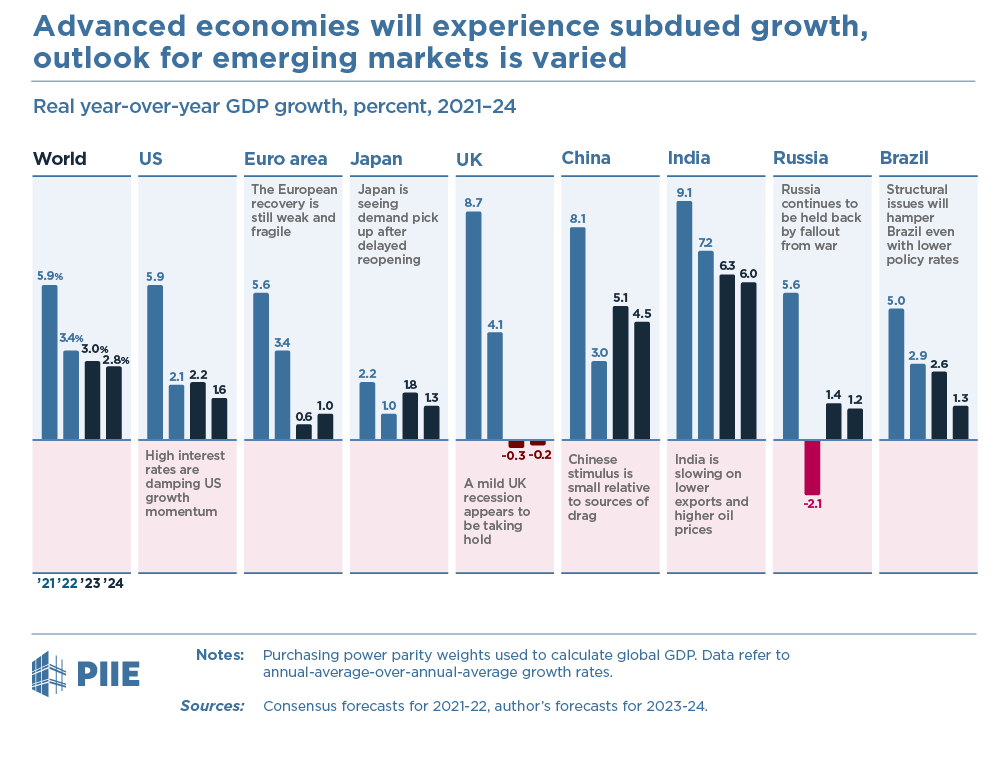

After growing 3.4 percent in 2022, the global economy is projected to expand 3 percent in 2023 and 2.8 percent in 2024. A soft landing in most countries is likely but not assured.

Analysis presented at the Peterson Institute for International Economics (PIIE) Fall 2023 Global Economic Prospects finds that while inflation appears to be receding in most countries, it remains decidedly above central bank targets. As a result, most central banks will need to keep their policy rates high over the coming year, with the resulting tight financial conditions holding back demand and slowing economic activity. However, the available information suggests that most countries will experience below-trend-but-positive growth as inflation moderates, not recessions.

Outlook for the US economy

The US economy has seen more solid growth this year than previously expected, but higher interest rates will dampen growth momentum going forward. Economic activity appears to have accelerated in the third quarter of 2023, but a lull is likely in the fourth quarter owing to the strike by the United Automobile Workers (UAW), restart of student loan payments, and a probable government shutdown. US real GDP is expected to remain below its potential level throughout next year, with growth moderating from 2.2 percent in 2023 to 1.6 percent in 2024 (see figure). Meanwhile the unemployment rate will rise modestly from its current level of 3.8 percent to 4.2 percent by the end of 2024.

This soft-landing scenario is consistent with incoming data suggesting that the US labor market has made considerable progress toward rebalancing and that underlying US inflation is subsiding. However, with inflation still well above the Federal Reserve’s target level of 2 percent, the Fed is expected to raise the policy rate by a further 0.25 percentage point at its December 2023 meeting to a peak of between 5.5 and 5.75 percent. The Fed is likely to keep the policy rate on hold until the fall of 2024 when the 12-month change in core personal consumption expenditures (PCE) inflation sinks below 3 percent. At that point, the Fed is expected to begin to slowly cut rates, with the policy rate returning to a neutral level only after a couple of years. Core PCE inflation (on a four-quarter basis) is projected to be 3.8 percent in 2023 and 2.8 percent in 2024.

Outlook for other large economies

Most other large economies will see different degrees of subdued growth in 2024. As in the United States, restrictive financial conditions will hold back economic activity in the euro area and the United Kingdom, with the latter having recently entered a mild recession. On a year-over-year basis, UK real GDP growth is projected to decline 0.3 percent in 2023 and 0.2 percent in 2024. European growth may pick up a bit in 2024, but the recovery there remains fragile. PIIE projects euro area real GDP growth to be 0.6 percent in 2023 and 1 percent in 2024. Chinese economic growth continues to wobble as relatively modest stimulus measures are more than offset by lingering effects of the property crisis, weak consumer demand, and unsustainable local government debt. Chinese real GDP is projected to grow 5.1 percent in 2023 and 4.5 percent in 2024. Growth is likely to remain solid in both India (6.3 percent in 2023 and 6.0 percent in 2024) and Japan (1.8 percent in 2023 and 1.3 percent in 2024), albeit slower in 2024 than it was in 2023. Japan’s growth has surprised to the upside in 2023, with its economy having experienced a boost from a pick-up in tourism after a delayed reopening from COVID-19.

There are three risk scenarios, all of which could eventually result in the United States and some other countries entering recessions:

- Risk scenario one: Underlying demand (particularly in the United States) may be stronger than the current consensus given potentially sizable amounts of excess savings and support to income from strong labor markets. In this case, the Fed may need to tighten considerably further, which increases the chance of a hard landing.

- Risk scenario two: Onset of a global malaise in which a European recession, a weakening Chinese economy (and its spillovers to the rest of Asia), and a troubled US banking sector dampen demand considerably further. In this case, monetary policy may not be able to respond quickly enough to avoid a recession.

- Risk scenario three: Inflation could materially reaccelerate because of developments in global commodity markets that push up energy and food prices or significant further disruptions to supply chains. This scenario would be especially challenging for the Fed and other central banks—with more tightening amid an economy already weakened by the supply shocks.

Data Disclosure

This publication does not include a replication package.