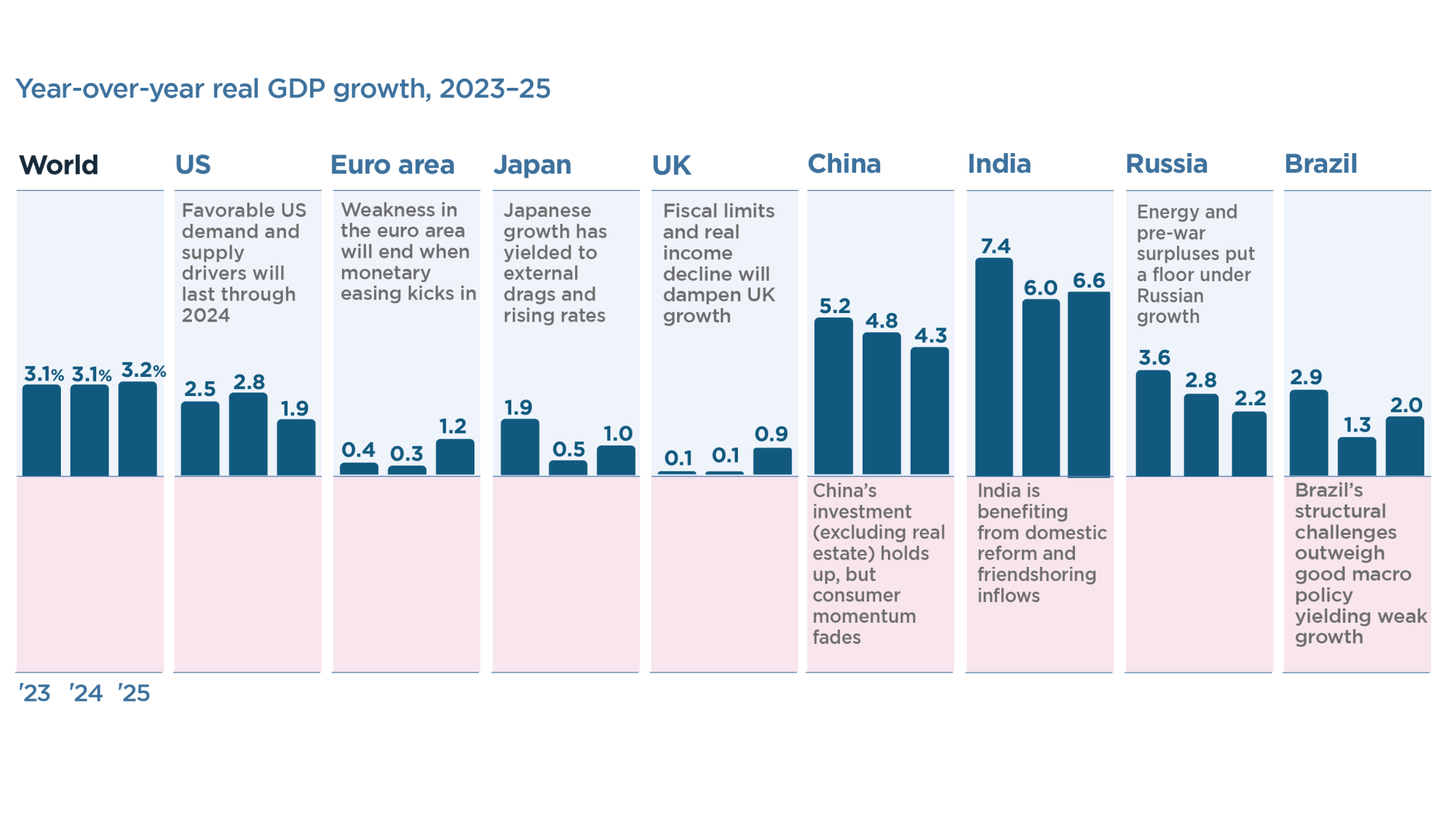

The Peterson Institute for International Economics is projecting continued global growth in 2024 and 2025. Real global GDP is projected to increase 3.1 percent in 2024, matching its 2023 pace, and post a gain of 3.2 percent in 2025. However, inflation in most countries remains some distance above many central banks' targets, so most central banks are keeping interest rates high as they watch and wait for more disinflation. But financial conditions are not so restrictive as to lead to widespread recessions.

The steadiness of global GDP growth masks substantial differences across countries. Most G7 economies are experienced soft landings but to different degrees. The United States leads because of favorable demand and supply drivers. The euro area, on the whole, has seen less economic momentum than the United States, but growth should pick up once monetary policy begins to ease.

A surge in tourism bolstered Japanese growth last year, but rising interest rates and an external drag from a weaker Chinese economy will temper economic performance going forward. Meanwhile, UK GDP is likely to continue to move sideways this year, with growth dampened by fiscal limits, real income declines, and a lingering Brexit drag.

The outlooks for the major emerging economies are shaped by a set of very divergent drivers. Notwithstanding its real estate crisis, China experienced a relatively brisk rebound in overall economic activity last year due to the resilience of consumer and private investment (excluding real estate). But the strength of Chinese consumption is likely to fade this year, producing a drag only partly offset by state-led investment. In contrast, India is likely to continue to grow robustly, boosted by domestic reform and a pickup in foreign investment due to "friendshoring."

Pre-war surpluses and demand for Russian energy exports have put a floor under Moscow's growth. Finally, although Brazil's monetary policy response to inflation is viewed as a success, structural challenges are likely to keep the country's growth below the pace it experienced in the early 2000s.

Details about US Economic Performance

One striking development of the past year is the degree to which real US GDP growth has surprised to the upside. On a year-over-year basis, PIIE now projects that US GDP will rise at a robust 2.8 percent pace in 2024—a much higher figure than forecasters were projecting six months ago.

The underlying drivers of household demand in the United States have remained strong. Real income growth has been buoyed by a healthy labor market, and the available data suggest that many households—across the income distribution—have higher net worth than they did before the pandemic. Moreover, housing and business investment have held up despite high interest rates.

Positive supply-side developments have allowed US demand to remain robust without pushing up inflation. Most importantly, a previously unrecognized surge in immigration has significantly boosted US productive capacity ("potential output") in recent years. Potential output has also been supported by productivity gains and buoyant labor force participation.

Even with these favorable supply-side developments, recent data suggest a stalling of progress in bringing US inflation back to its target levels. As a result, the Federal Reserve is likely to cut rates only very slowly. Given this policy, US growth is projected to slip from 2.8 percent in 2024 to 1.9 percent in 2025, and the US unemployment rate is projected to rise by about 0.25 percentage point to 4.1 percent this year and stay at this level in 2025. This moderation of demand is projected to lead core personal consumption expenditure (PCE) inflation to sink to 2.5 percent in 2024 and 2.3 percent in 2025.

While "soft landing" forecasts are the mostly likely outcome for the United States and other major economies, recession risk is still somewhat elevated given geopolitical uncertainties as well as the potential for more inflationary supply shocks and asset price corrections.

Data Disclosure

This publication does not include a replication package.