President Donald Trump's budget is premised on the projection that the United States will be able to raise its long-run economic growth rate to 3 percent a year. This rate allows the budget to assume large tax cuts and still project a balanced budget after ten years. This long-run forecast represents the largest divergence between an administration forecast and that of either the consensus forecast of the Blue Chip survey of private forecasters (2.0 percent) or that of the nonpartisan Congressional Budget Office (CBO, 1.9 percent) in many decades.

For example, the administration's forecast is 1.0 percentage point above the Blue Chip consensus—whereas in the 24 budgets under Presidents Bill Clinton, George W. Bush, and Barack Obama, the administration never once forecast long-run growth more than 0.1 percentage point above the Blue Chip. In fact, the optimism of the Trump administration's forecast relative to the Blue Chip is larger than that of any administration since at least 1984 (see figure 1), and the administration's forecast shows the greatest difference relative to CBO's since at least 1977.

Given the substantial uncertainty about the future, 3 percent growth is certainly possible. As Edward Lazear, former chairman of the Council of Economic Advisers under President Bush, wrote in a recent Wall Street Journal op-ed, annual growth of 3 percent is "possible with some luck on the technology front and if augmented by investment-friendly tax policy." But is it likely?

To assess how likely the United States is to experience 3-percent growth over the next decade, I estimated the likely range of future potential GDP growth by taking random draws from the history of productivity growth rates, changes in the labor force participation rate, and changes in average hours worked (see the appendix for more details). In running 10,000,000 simulations, the estimated median annual growth rate over the next decade was 1.8 percent, while the 90-percent confidence interval ran from 0.7 percent to 3.0 percent (see figure 2). The odds of the growth rate being at or above 3 percent are only 4 percent—essentially requiring the economy to repeat some of the fastest productivity growth it has seen over the past seven decades.

The policies proposed by the Trump administration could have a small effect on the future growth rate. Some, like tax reform or regulatory reform, could raise the growth rate above forecasters' current consensus, while others, like restrictions on trade or immigration or large increases in the budget deficit, could lower it. As I have argued elsewhere, however, none of these policies would change the growth rate by more than a few tenths of a percentage point over the next decade, and thus do not materially affect this analysis. Moreover, by drawing on past history, this analysis itself effectively incorporates not only uncertainty about the economy but also a range of policy outcomes.

Fundamentally, the economy faces daunting obstacles to achieving sustained 3-percent growth. First, the baby boom generation, which powered much of the growth from the 1970s through the beginning of the 2000s, is now turning into the retirement boom generation—dramatically slowing workforce growth. In the 1980s, the prime-age population (those ages 25 to 54) grew at a 2.2 percent annual rate, whereas over the next decade that growth rate is only expected to reach 0.5 percent a year (figure 3). Second, much of US growth of the second half the 20th century was fueled by the influx of women into the workforce, a trend that appears to have run its course by around 2000. Finally, productivity growth has been weak across all of the advanced economies (figure 4). While there are many reasons to be optimistic about future productivity growth, an upswing is far from assured.

Appendix: Details of the Simulation

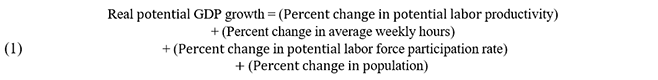

A Monte Carlo simulation was used to generate a probability distribution of a range of outcomes for potential growth over the next decade. By construction, the distribution of outcomes is centered on CBO's 1.8-percent estimate for annual potential growth from 2016 to 2026. For the simulation, the results of repeated draws from independent distributions of the inputs to potential growth shown in equation (1) are combined to generate estimates of potential growth. Potential productivity growth is drawn from a normal distribution with the mean equal to CBO's forecast and variance equal to that of the historical distribution of CBO's estimates of ten-year changes in potential productivity from 1949 to 2016. Average weekly hours growth is drawn from a normal distribution with a mean of zero and variance equal to the historical distribution of ten-year changes in average weekly hours reported by the Bureau of Labor Statistics (BLS). In all cases, population growth is assumed to be equal to CBO's forecast and is not subject to random draws.

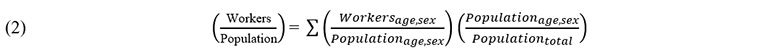

Forecasts for the overall potential labor force participation are aggregated from forecasts for labor force participation rates for specific sex and age groups (male and female; ages 16–24, 25–54, and 55 and older) using forecasts of population shares for each group derived from Social Security Administration data (which are assumed, like overall population growth, to be deterministic):

In the Monte Carlo simulation, repeated draws are taken for each age and sex group from independent distributions of ten-year changes in its participation rate. To approximate CBO's projections, which attribute most of the decline in potential labor force participation to the effects of aging, all distributions are assumed to have a mean of zero (i.e., no change in within-group participation rates over the next decade). The variance for each distribution is taken from the variance of the historical distribution of ten-year changes in the participation rate for the age-sex group in question. Once aggregated, each combination of draws yields a path for the labor force participation rate over the next ten years relative to a baseline with no change in age- or sex-adjusted participation; this path is then rebased using CBO's estimate of potential labor force participation to yield a path for potential labor force participation from 2016 to 2026.

| Table 1 Summary statistics: Monte Carlo simulation (n=10,000,000) | ||||

|---|---|---|---|---|

| Potential labor productivity growth percent, annual rate |

Change in average weekly hours percent, annual rate |

Change in potential labor force participation rate percentage points, annual rate |

Potential real GDP growth percent, annual rate |

|

| Mean | 1.7 | 0.0 | -0.2 | 1.8 |

| Standard deviation | 0.6 | 0.2 | 0.2 | 0.7 |

| 5th percentile | 0.7 | -0.4 | -0.5 | 0.7 |

| 25th percentile | 1.3 | -0.2 | -0.3 | 1.3 |

| 50th percentile | 1.7 | 0.0 | -0.2 | 1.8 |

| 75th percentile | 2.1 | 0.2 | -0.1 | 2.3 |

| 95th percentile | 2.6 | 0.4 | 0.1 | 3.0 |

| Sources: Bureau of Labor Statistics, Congressional Budget Office, Social Security Administration, and author's calculations. | ||||