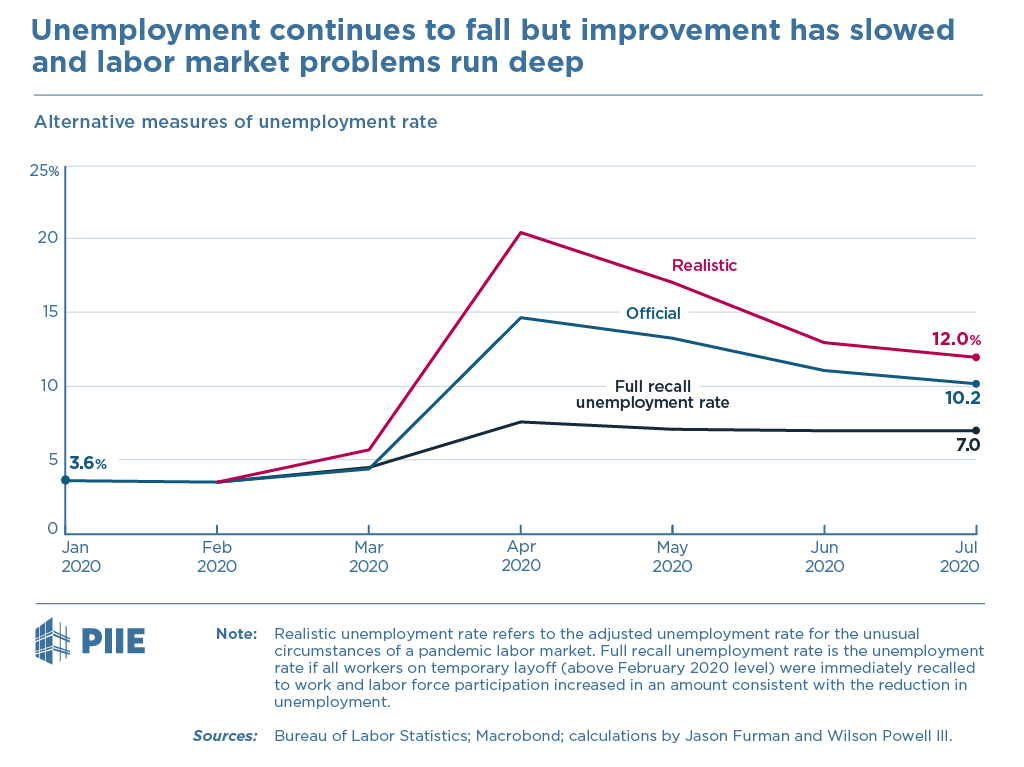

The official unemployment rate continued to fall in July from 11.1 in June to 10.2, a slowdown from the improvement in May and June. As in prior months of the pandemic, the official unemployment rate continues to understate the unemployment rate from a historically-comparable perspective because it counts an extra 1.4 million people who were "not at work for other reasons" as employed (the so-called "misclassification error") and also because 4.7 million people have left the labor force since February, more than would be expected even given this large increase in unemployment. Adjusting for these factors our "realistic unemployment rate" was 12.0 percent in July, falling slightly faster than the official unemployment rate. The small reduction in this gap reflects continued improvement in reducing the misclassification error that was partially offset by a slight fall in labor force participation, a potentially worrying sign this early in the recovery.

In total, an additional 8.4 million of the unemployed since February reported being on temporary layoff, many of whom may anticipate a return to work after the end of COVID-19 pandemic lockdowns. If all of these people were immediately recalled back to work and the labor force adjusted accordingly—a very optimistic scenario—the "full recall unemployment rate" would still be a very elevated 7.0 percent. Unlike the "realistic unemployment rate," which fell along with the official unemployment rate in July, the "full recall unemployment rate" remained unchanged from June. These data suggest the temporary labor market problems are very deep and that even if individuals on temporary layoff returned to work very quickly, the United States would still have a recessionary level of unemployment for some time to come.

The evolution of these three alternative measures of unemployment—official, realistic, and full recall—is shown in the figure below.

The "realistic unemployment rate": Adjusting the unemployment rate for the unusual circumstances of a pandemic labor market

This analysis makes two adjustments to the official unemployment rate to develop a "realistic unemployment rate" that is intended to be more comparable to historic measurements of the official unemployment rate, what the US Bureau of Labor Statistics (BLS) calls U-3.

The first adjustment is to reclassify the additional 1.4 million workers who reported being "not at work for other reasons" as unemployed. The BLS explained that its "analyses of the underlying data suggest that this group may still include some workers affected by the pandemic who should have been classified as unemployed on temporary layoff." The extent of this misclassification issue has declined considerably since its peak in April but remains important.

The second adjustment reflects the very large reduction in labor force participation, which was unusually large even conditional on the large increase in the unemployment rate. The labor force participation rate fell 2.0 percentage points between February and July as 4.7 million more people without employment also did not actively look for work and thus were not counted as being unemployed or part of the labor force. To put this in context, from 2007 to 2009, as the unemployment rate jumped to 10.0 percent, the participation rate fell only 1.2 percentage point (or 0.8 percentage point adjusted for population aging). This suggests that some of the people exiting the labor force since February may have done so temporarily because of the difficulty and impracticality of searching for the jobs during the peak pandemic period.

Unlike in prior months, when labor force participation increased as the unemployment rate fell, labor force participation fell slightly in July despite the continued improvement in the unemployment rate, a potential warning sign for the prospects of continued labor market improvements in the coming months.

In order to make the labor force statistics more comparable to previous episodes, we reclassify some people reporting that they were not in the labor force as unemployed—meaning that they would be looking for work—so that, adjusted for aging, the relationship between labor force participation and the unemployment rate matches that observed during the Great Recession. This does not attempt to adjust for the full decline in labor force participation since February, only the portion of the decline that is unusually high relative to past downturns. The result is 1.6 million more people classified as unemployed, the counterfactual labor force participation rate rising by 0.6 percentage point and the counterfactual unemployment rate rising to 12.0 percent, as shown in the table below.

Note that this "realistic unemployment rate" differs from the broader labor underutilization measures published by the BLS. The BLS publishes U-4 which adds discouraged workers, U-5 which also adds other marginally attached workers who are available for work but not actively looking for a job, and U-6 which further adds those involuntarily working part-time for economic reasons. These measures are, by definition, always higher than U-3 because they add to the unemployed. In contrast, the "realistic unemployment rate" adds only the unusually large increase of nonparticipants to the unemployed, thus making it comparable to previous headline unemployment rates. This procedure, however, entails a hypothetical counterfactual exercise whereas U-4, U-5, and U-6 are all based directly on survey responses.

| February 2020 | March 2020 | April 2020 | May 2020 | June 2020 | July 2020 | Change: Feb. to Jul. (p.p.) | ||

|---|---|---|---|---|---|---|---|---|

| Official | ||||||||

| Unemployment Rate | 3.5 | 4.4 | 14.7 | 13.3 | 11.1 | 10.2 | 6.7 | |

| Labor Force Participation Rate | 63.4 | 62.7 | 60.2 | 60.8 | 61.5 | 61.4 | -2.0 | |

| Realistic | ||||||||

| Unemployment Rate | 3.5 | 5.7 | 20.5 | 17.1 | 13.0 | 12.0 | 8.4 | |

| Labor Force Participation Rate | 63.4 | 63.0 | 60.9 | 61.4 | 61.9 | 62.0 | -1.4 | |

| Full Recall | ||||||||

| Unemployment Rate | 3.5 | 4.5 | 7.6 | 7.1 | 7.0 | 7.0 | 3.5 | |

| Labor Force Participation Rate | 63.4 | 63.2 | 62.8 | 62.8 | 62.8 | 62.7 | -0.6 | |

| Note: p.p. denotes percentage points. Change based on unrounded numbers. Source: Bureau of Labor Statistics; Macrobond; authors' calculations. |

||||||||

The "full recall unemployment rate": What would happen if all furloughed workers were immediately called back

In July 9.2 million workers reported being on temporary layoff, much higher than the 801,000 in February. Note that the BLS changed its procedures and adopted a relatively broad definition of temporary layoff, so this number may include workers who have not in fact been furloughed from their jobs but were actually fired (see here for a full discussion).

It is unclear how many temporarily laid off people will return to their employers. Historically about 70 percent of workers on temporary furloughs return to their jobs, but this historic experience may not be applicable in the current circumstances. Assuming optimistically that all workers newly on temporary layoff had returned to their jobs (and following the BLS in counting those "not at work for other reasons" as employed) the unemployment rate would have been 5.0 percent in July, unchanged from June and well below the 7.1 percent June unemployment rate in the European Union, which generally counts furloughed workers as employed.

This, however, is an artificially low unemployment rate because it makes the optimistic assumption that 8.4 million people return to their jobs while simultaneously assuming no commensurate increase in people looking for jobs. Any economy in which 8.4 million people were rehired would also see an increase in labor force participation from the still low July rate given the greater availability of jobs. To address this, our "full recall unemployment rate" makes the counterfactual assumption that 3.5 million people re-enter the labor force, again making the change in the age-adjusted participation rate consistent with its historic relationship with the change in the unemployment rate.

Conclusion

By any measure the US economy, like other economies around the world, experienced a dramatic reduction in economic activity that put millions of people out of work through early July, the time period covered by this report. The future prospects of the labor market will depend on the trajectory of the virus—cases appear to have plateaued again after rising in July, the further policy response—Congress has yet to reach a deal on the extension of the $600 per week in additional unemployment benefits, aid to state and local governments, or additional support for businesses, and on how many people without jobs can quickly connect with their old jobs instead of undertaking the time consuming process of finding a new job, or even a job in a new industry.

Understanding the data can help inform projections of the trajectory of labor market recovery. This is consistent with a "partial bounce back" in the labor market, as the unemployment rate falls quickly at first, followed by a "slog" where the unemployment rate slowly falls but remains at an elevated level for a prolonged period. Further progress in the "partial bounce back" phase will only get harder, especially if the virus remains a widespread concern. Of course, this is just one of many other possible future trajectories for unemployment, so a better understanding of the recent past of employment can only shed a tiny bit of light on the future of employment.

Related Documents

- Fileunderlying data [furman2020-08-07.zip] (1.18 MB)