This is part 1 in a series about China’s property market.

In this post we try to give a broad update of China’s property market the past several years. We take a look at housing prices versus quantity of floor space then we’ll wrap up with an overview of the housing policies Beijing implements in order to tame, and stimulate, the property market. One consistent observation is that the property market is in the midst of a correction, of which we have yet to see the bottom.

Real estate prices in China are in their steepest price declines more than 10 years. As we mentioned here, 69 of 70 major cities reported that their housing prices declined in the last two months. As shown in chart 1, year-over-year declines in the monthly report of housing prices fell 4.35 percent in March, marking 6 straight months of declines. However, the blue line shows that the price per square meter is down less than 5 percent from its peak of 11,000 RMB in March of 2013. This is still a long way off the sharp and protracted corrections seen in the US and parts of Europe, which were more than 30 percent in some cases. Looking at the price per square meter helps keep a reasonably consistent measure on the price trends of real estate, while the growth rate is compared to price in the same month of the previous year.

Chart 1: Growth rate of housing prices vs price per square meter of housing

Source: Thompson Datastream

From a quantity perspective, floor space for housing shows that activity has slowed down significantly since the massive amount of new construction from the 2nd half of 2009 through the end of 2010 (chart 2 below). Housing starts picked again from mid-2013 to February of 2014 and we saw a small uptick in completions in mid-2014. For all but 3 months from March 2013 to the end of the year there was negative growth in housing starts, and growth for completions was in the single digits for the end of 2014. With negative growth recently in housing starts, especially the latest drop of 25 percent, and already low growth in housing completions, it is likely that growth in housing completions will drop negative in the near term. This is reinforced by looking at absolute starts and completions of floor space. Currently, there are around 5.8 billion square meters more starts than completions, and the completions last year was 1.5 billion square meters, so all else equal, if there were zero housing starts, it looks like construction would last around 4 years.[1] This data shows two things, that there isn’t a big buffer for continued construction, but also not a big chance there is a large amount of deserted construction projects for housing out there.

Chart 2: Housing starts and completions by floor space (% yoy, 3 month average)

Source: Bloomberg

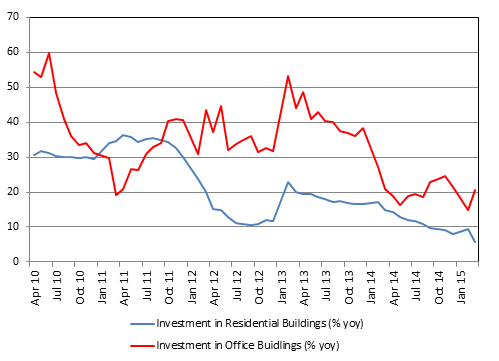

Corroborating the price and activity weakness, investment in both residential and commercial property has slowed significantly. Indeed investment growth in office buildings was at its lowest in more than 5 years, although it is still growing at 15 percent over the same period the previous year. While this may still appear elevated, the overall rate of investment growth has halved since last year and has declined continuously (with a brief exception in 2012) since the credit deluge of 2009. There’s little reason to think that this trend is going to abate in the near term because of the slowing momentum in China’s economy, and indeed if the reports about stalled construction projects are true, growth rates are sure to slow closer to zero.

Chart 3: Growth of fixed asset investment, residential and office buildings

Source: Thompson Datastream

China’s government has been adept at enacting targeted counter-cyclical policies to control the housing market. In the past, policies were aimed at creating barriers for speculators to borrow money to invest in real estate, like pushing up interest rates, setting limits on bank lending, requiring large down payment (sometimes more than 60 percent) on purchases of second homes, and even introducing real estate taxes. More recent measures included China’s central bank lowering the baseline interest rate twice in the last six months, as well as lowering the reserve requirement ratio -- the amount of deposits a bank must hold. Some newer measures by the PBoC have encouraged banks to increase support for home purchases by tapping into a housing subsidy fund, lowering the down payment on second homes, and a removal of a tax on housing sales.

The constraints on the housing market are still very restrictive, thus the authorities retain substantial latitude to further loosen policy. They have of late demonstrated a propensity to use incremental loosening from the current high levels, as opposed to credit expansion. However, with home ownership at very high levels and expectations for future growth lowering, how much demand for housing remains is an open question.

[1] We recognize that there are certain challenges to measuring the quality of housing starts, but we take a naïve approach here assuming all housing starts are actual projects underway.