The labor market was essentially unchanged at the start of 2021 as employers added 49,000 jobs in January. Overall, the economy is 11.6 million jobs below its pre-pandemic trend with the unemployment rate elevated and the employment rate having fallen even more as millions of people have left the labor force. Unusually, while the unemployment rate has fallen steadily from 11.1 percent in June 2020 to 6.3 percent this past month, this has not been accompanied by a return of people to the workforce—as the labor force participation rate has been essentially unchanged at 61.4 percent for the last seven months. As a result the realistic unemployment rate, which is more comparable to historical numbers for the unemployment rate, stood at a very high 8.3 percent in January.

The realistic and full recall unemployment rates fell in January but remain elevated

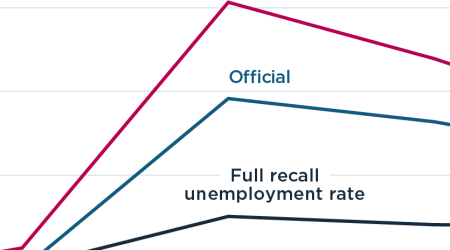

The headline unemployment rate was 6.3 percent in January, down from 6.7 percent in December. This concept works well in normal times but has had some deficiencies in the context of the pandemic. In response to these unique circumstances, we have been publishing monthly updates since June tracking what we call the “realistic unemployment rate” and the “full recall unemployment rate” as shown in figure 1. We explained the methodology for these two concepts in our earlier updates.

The realistic unemployment rate adds 848,000 workers who reported being “not at work for other reasons” as unemployed and also adds 2.5 million workers to the labor force to reflect the fact that the decline in labor force participation has been unusually large, even conditional on the overall economic weakness (note that this is only a portion of the 4.3 million workers who have left the labor force since February 2020). This measure was 8.3 percent in January and is intended to be historically comparable to the official unemployment rate, unlike other concepts that, by construction, are always higher than the official unemployment rate (e.g., the U-6 measure of broad labor underutilization). The January value represents an improvement after rising in December and is now at its lowest level since March, though improvement since the fall has been modest.

The full recall unemployment rate attempts to reflect the fact that part of the increase in unemployment is temporary and that it is relatively easy to call back workers from temporary layoff as conditions improve. Indeed, we have seen a rapid reduction of workers on temporary layoff but, they still numbered 2.7 million in January, much higher than the 801,000 in February 2020. It is unclear how many temporarily laid off people will return to their employers. Historically about 70 percent of workers on temporary furloughs return to their jobs, but this historic experience may not be applicable in the current circumstances. The full recall unemployment rate optimistically assumes that all workers newly on temporary layoff had returned to their jobs. In such a situation people would also re-enter the workforce; based on historic relationships between unemployment and labor force participation, we assume that 3.0 million of the 4.3 million who exited the labor force since February last year will return. With these two adjustments, the full recall unemployment rate was 6.9 percent in January. The full recall unemployment rate fell slightly from December, but the gap between it and the official unemployment rate has been expanding, suggesting that further improvement will have to come increasingly among those experiencing permanent job loss.

| February 2020 |

November 2020 |

December 2020 |

January 2021 |

Change: Feb. to Jan. (p.p.) | |

| Official | |||||

| Unemployment Rate | 3.5 | 6.7 | 6.7 | 6.3 | 2.8 |

| Labor Force Participation Rate | 63.3 | 61.5 | 61.5 | 61.4 | -1.9 |

| Realistic | |||||

| Unemployment Rate | 3.5 | 8.4 | 8.6 | 8.3 | 4.9 |

| Labor Force Participation Rate | 63.3 | 62.4 | 62.3 | 62.4 | -1.0 |

| Full Recall | |||||

| Unemployment Rate | 3.5 | 7.1 | 7.0 | 6.9 | 3.4 |

| Labor Force Participation Rate | 63.3 | 62.6 | 62.6 | 62.6 | -0.7 |

| Note: p.p. denotes percentage points. Change based on unrounded numbers. Sources: Bureau of Labor Statistics via Macrobond; authors' calculations. |

|||||

As the unemployment rate remains elevated, the employment-population ratio is 3.6 percentage points below its pre-pandemic value

Last month, the employment-population ratio, the share of the civilian adult population that is working, increased slightly. Overall, the employment-population ratio has fallen from 61.1 in February 2020 to 57.5 in January. The change in the employment-population ratio accounts for both the change in unemployment and the change in labor force participation and thus fully captures the change in employment. Our alternative measures of unemployment capture the abnormally large increase in the number of people who have stopped looking for work, but the employment-population ratio accounts for the entire decrease in labor force non-participation.

The ranks of the long-term unemployed continued to edge up in January and have increased by almost 3 million since last February

The number of long-term unemployed, those without a job for 27 or more weeks, continued to slowly increase in January. While the increase has slowed in recent months, the number of long-term unemployed stands at 2.9 million above its February 2020 level as shown in figure 3. The long-term unemployment rate remained at 2.5, its highest level since 2013.

Economic evidence shows that long-term unemployment can have a scarring effect, making it harder for a worker to find a job, more likely for them to drop out of the labor force for a sustained period, or likely to suffer from persistent reductions in wages.

Conclusion

Understanding the data can help inform projections of the trajectory of labor market recovery. We saw an initial “partial bounce back” in the labor market in the late spring and summer of 2020, as the unemployment rate fell quickly at first as businesses reopened, but the pace of recovery has slowed throughout the fall, and temporarily reversed in December.

The future prospects of the labor market will depend on the trajectory of the virus, the future policy response, and how many people without jobs can quickly connect with their old jobs instead of undertaking the time-consuming process of finding a new job, or even a job in a new industry. In the short term, virus cases and hospitalizations remain high but have fallen from their peaks, while deaths continue to remain elevated. This has not only caused enormous human suffering but could slow economic recovery as well. The COVID-19 relief included in the December Consolidated Appropriations Act will provide substantial support, but more action is needed, especially in deploying vaccines and testing, extending unemployment programs past March, and providing additional aid for states and localities.

If the virus is brought under control, the economy should have sufficient aggregate demand to support rapid growth in 2021. This demand would be satisfied by putting millions of workers back to work and bringing millions more back into the labor force. The challenges of a speedy labor market adjustment grow the longer and worse the underlying unemployment situation gets.

Related Documents

- Filefurman-powell2021-02-05.zip (1.25 MB)