Imagine dealing with an adversary which does not feel itself bound in any way by international legal norms, and indeed believes that such norms are only shackles that threaten its very existence. The result? What Justin Hastings calls “A Most Enterprising Country” in his terrific new book on North Korea and the world economy from Cornell University Press. North Korea does not do sanctions evasion on the side; it is a central focus of the regime’s entire foreign economic policy. But the evidence is now piling up on what North Korea is managing to do and how it is doing it. As it does, there are fewer and fewer reasons to shun secondary sanctions, and there is some solid reporting that the Trump administration is focused on the issue (Jay Solomon at the WSJ, behind a paywall).

The evidence is accumulating on how North Korea uses Chinese brokers to evade sanctions, including multilateral sanctions to which China has agreed.

The UN Panel of Expert reports were always useful, but are getting better and better at tracking down particular entities, including continually-morphing North Korean shell companies and their suppliers and customers. (The most recent report can be found here; the Panel’s website and links to earlier reports here). The reports find evidence of prohibited transactions with a variety of countries, from a number in Africa, to Sri Lanka, to European parts and components that found their way east to Austrian equipment installed at Masik Pass. But because so much ultimately passes through China, it is useful to note just some of the Chinese cases, as each has a lesson for how the broader sanctions-evasion business works:

- By simply looking at stationary and websites, the Panel found that Korea Kumsan Trading Company has the same address, and is effectively controlled by, North Korea’s General Department of Atomic Energy. “Multiple online commercial sources advertise Kumsan’s business activities in Moscow and Dandong, highlighting dealings in ‘metal minerals and mineral ore, including vanadium ore,’” which is explicitly proscribed by UN sanctions. Why is Kumsan operating and not itself designated?

- Debris recovered from the February 2016 space launch recovered UK parts that the Panel traced “to a Beijing-based company, which sold them on to Beijing Xinjianteng Century Technical Technology. This company was unable to provide the identity of the purchaser and indicated that the pressure transmitters had been sold in an electronics market.” Export controls are hard and involve effort, but if not smuggled why is this technology being exported from China to North Korea?

- On 11 August 2016, Egypt intercepted the Jie Shun with a large shipment of rocket-propelled grenades hidden beneath 2300 tons of iron ore. On the bill of lading, the address of the shipper, “Dalian Haoda Petroleum Chemical Co. Ltd”, was a hotel in Dalian. The coal was consigned through a Dandong-based company. Such cases are particularly hard given the incredible volume of China’s trade. But Chinese nationals appear to be involved in the web of shell companies that effectively managed the Jie Shun.

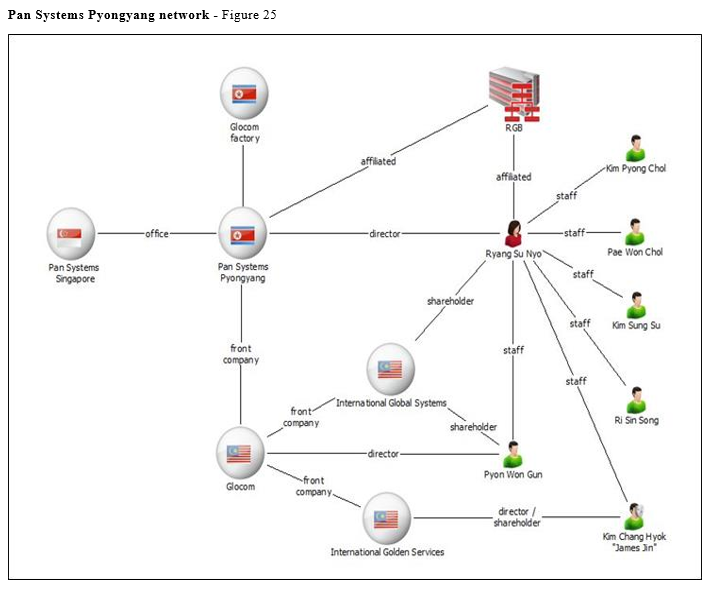

Military radios destined for Eritrea were shipped to the country from China by Beijing Chengxing Trading Co. Ltd.; this case provides a link to Glocom we noted in a recent post on Malaysia and the deeper network of companies tied to the Reconnaisance General Bureau that have been operating in Southeast Asia, including in Singapore. Spare Scud parts were also shipped to Egypt and other military hardware elsewhere in Africa through intermediaries in China.

- North Korean drones were manufactured by Beijing-based company Microfly Engineering & Technology, but acquired through a chain involving another Beijing-based company (RedChina Geosystem Co Ltd.) which in turn sold them to another Chinese buyer (Mr. Zhu Zhong Xian 朱忠贤) who in turn appears to have sold them to North Korea. Again, it is quite possible that such shipments were just mislabeled. But that raises the question of whether tougher inspections aren’t necessary given the manifest effort of the North Koreans to evade sanctions.

- Light aircraft manufactured in New Zealand and Italy found their way to North Korea through a Chinese buyer. A case like this is particularly egregious. Aircraft?

- A large section of the report goes through a number of explicitly designated entities that were registered as fronts and in some cases even under their own names in China. Some were formally deregistered in China—which is good—but have continued to operate, which is not. Hong Kong appears to provide haven to a number of shell entities connected with these trading networks in China, which falls on Hong Kong authorities. The financial forensics involved in these cases involved trolling Chinese and Hong Kong business registries.

- The report does provide information on some of the Hongxiang entities that the Chinese government did ultimately close down (see our post on the C4ADS report that called them out here). But the report also shows how banking services are contracted as well as trading functions. The Korea Kwangson Banking Corporation (KKBC) was a designated entity, but it was one of two major shareholders of Dandong Hongxiang Industrial Logistics Co., Ltd. which in turn was related to Dandong Hongxiang Industrial Development Co. Ltd. (Dandong Hongxiang), which was in turn acting for or on behalf of KKBC. This case is important in showing how financial services might be provided indirectly through non-financial entities. “The Chinese business registry shows that several entities of the Democratic People’s Republic of Korea established joint venture companies with Dandong Hongxiang. These include Korea Kwangson Banking Corporation and Korea National Insurance Corporation,” suggesting that the links extend to broader financial services.

- In some cases, the provision of banking services is more direct. A North Korean bank named Chinese Commercial Bank (中华商业银行) in Rason was established in 2013 by China Gold Trade Exchange (Dalian) Co., Ltd. (金贸易货交易(大连)有限公司, annex 15-4). A Chinese official actually gave a speech at the ribbon-cutting ceremony, specifically mentioning the provision of trade financing. The bank’s activities may or may not be proscribed, but does anyone want to take bets on the entities with which it does business?

- In an excellent piece of forensic work, the Panel has identified the travel of a number of designated individuals. Virtually every one of them transited through China, meaning that at some point they showed their passport to someone. This should not be hard: all you need is entry of designated individuals into a list of suspect travellers.

- The Panel simply collects the trade data on North Korean exports of iron ore, nominally banned under 2270. China accounts for 78% of the exports, about $60 million. Livelihood exemption indeed.

Had enough yet? Thankfully, that about covers the main clusters of activity, with the Panel concluding by quite sensibly calling on entities to be designated and member states to exercise due diligence over this kind of activity, particularly when carried out by embassy personnel. Marc and I have always argued that sanctions are not self-enforcing. You want to know the agenda for the US going forward on sanctions? This is a pretty good place to start.