Despite Beijing’s recent signal that it is ready to launch a larger-scale fiscal stimulus to help battle the economic fallout from the coronavirus pandemic, its fiscal space is running tight. For the Chinese government to control its growing deficit—estimated by the International Monetary Fund to be 9 percent of GDP in 2019, including both on-budget fiscal deficit and off-budget spending—it has to find a way to collect more nontax revenue. One rightful way to do so is to make its state-owned enterprises (SOEs) pay their fair share.

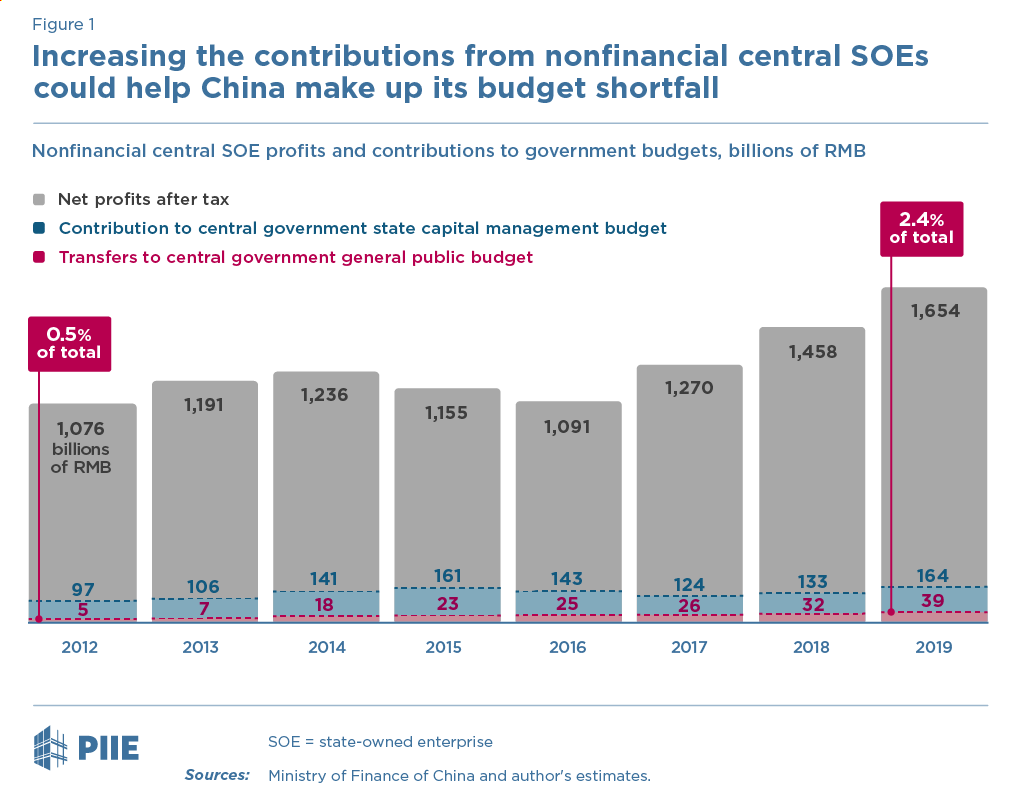

In 2019, only 2.4 percent of the after-tax profits of the central SOEs—those under the direct control of Beijing—in the nonfinancial sector went into China's central general public budget used to fund social programs (figure 1). If 30 percent had been turned over, as was the goal set by the Chinese leaders in 2013, at least another RMB450 billion (US$63.5 billion)[1] would have been added to the general public budget. This would have eased the government’s fiscal constraints greatly. China therefore must ramp up its long overdue campaign of raising more dividends paid by its SOEs.

In 2007 the State Council introduced a dividend policy for state firms directing them to turn over SOE dividends, but only a modest increase took place. Prior to that order, most state firms had historically paid little to no dividends to the government entities that owned them, even though the 1994 taxation reform outlined the dividend rates for such payments. While some publicly-listed SOEs did pay out a share of their earnings in dividends, they did not go to the Chinese government.[2]

Dividend payments differ between nonfinancial and financial firms. Nonfinancial firm payments go to a separate state capital management budget and are partially transferred to the general public budget later. These payments have been surprisingly small. During 2012–19, these nonfinancial central state firms made an impressive after-tax net profit of RMB1.27 trillion (US$179 billion) annually, or 1.7 percent of China’s GDP. But only 11 percent of this profit supported the state capital management budget. Of that amount, only 16 percent was transferred to the central general public budget. This means that only 1.7 percent of the after-tax profits of nonfinancial central SOEs actually went into the Chinese government’s main public budget during this period.

The State-owned Assets Supervision and Administration Commission, or SASAC, which manages most nonfinancial SOEs controlled by the central government, opposes these transfers, insisting instead that they be used for the SOEs themselves.[3]

On the other hand, dividends by state-owned financial institutions do not have to go through a cumbersome budget transfer and have been able to contribute more money to the central general public budget.[4] The Ministry of Finance is the owner or the majority owner of most state-owned financial institutions, and it is in its own interest to collect more dividends from them to manage the government finance. As a result, the state-owned financial institutions’ contribution to the central general public budget was 20 times their nonfinancial counterparts between 2014 and 2019. In 2019, central state financial institutions contributed RMB772 billion (US$108.9 billion) to the central general public budget, whereas the contribution of nonfinancial central state firms was only RMB39 billion (US$5.5 billion).[5]

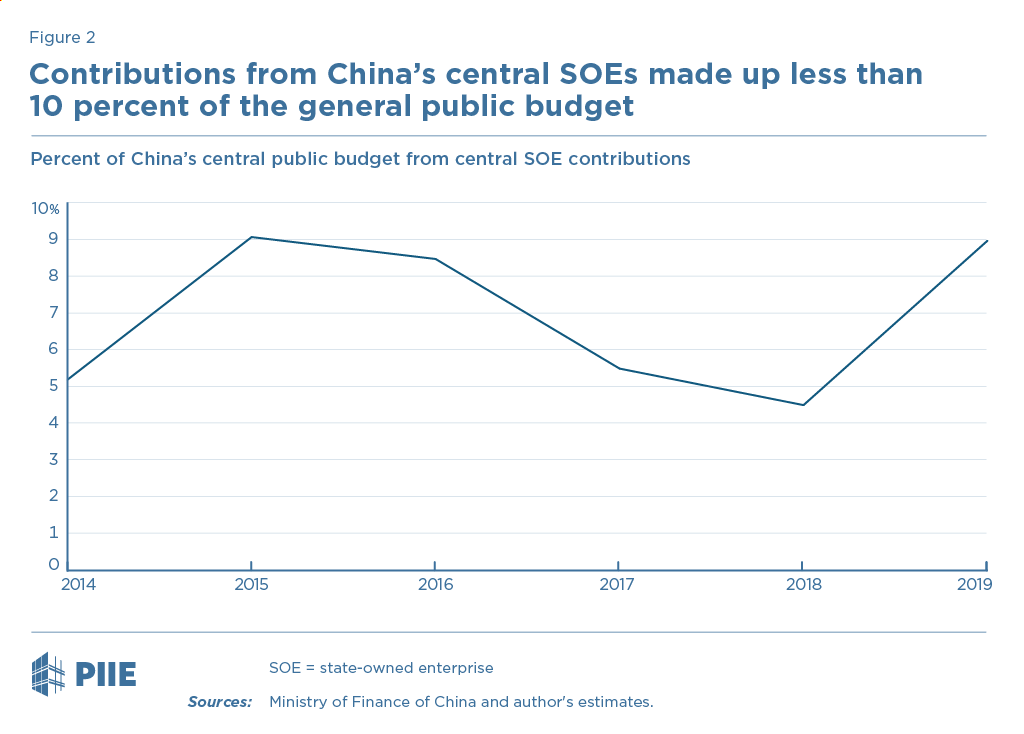

Thanks to the huge increase in the dividends paid by the state financial institutions in 2019, the contribution made by the whole state sector under the central government exceeded RMB800 billion (US$112.9 billion), more than double that of 2018, but it was still under 10 percent as a share of the central general public budget (figure 2). Premier Li Keqiang of China in his 2019 Government Work Report said these payments “should be increased.” The mounting pressures of the economic fallout from the COVID-19 pandemic could make that happen.

Notes

1. The exchange rate used to convert renminbi to US dollars in this post is as of April 2, 2020.

2. Louis Kujis, William Mako, and Chunlin Zhang, SOE dividends: how much and to whom? (World Bank Group, 2005).

3. There are only a few central nonfinancial SOEs outside the jurisdiction of SASAC, among which some of the more well-known include China Post, China Tobacco, CITIC, and China State Railway. See Nicholas R. Lardy, Sustaining China’s Economic Growth After the Global Financial Crisis (Peterson Institute for International Economics, 2012), p. 73; and Markets Over Mao: The Rise of Private Business in China (Peterson Institute for International Economics, 2014), p. 53.

4. Interestingly, the People’s Bank of China, China’s central bank, is sometimes also considered a state-owned financial institution. Some believe that the central bank also contributed a part of its profits to the government’s budget revenue in China in 2019.

5. The data for the revenue transfer from the state capital management budget to the general public budget in 2019 is not available yet. The RMB39 billion is calculated based on the assumption that the share of the transfer in the central government’s state capital management budget in 2019 stayed unchanged from 2018, when it was about 24 percent.