Annual Report

2024

Leading research on the global economy

The Peterson Institute for International Economics (PIIE) is dedicated to strengthening prosperity and human welfare in the global economy through expert analysis and practical policy solutions.

Founded in 1981 and led since 2013 by President Adam S. Posen, the Institute anticipates emerging issues and provides rigorous, evidence-based policy recommendations with a team of the world’s leading economists and policy experts. It creates freely available content in a variety of accessible formats to inform and shape public debate, reaching an audience that includes government officials and legislators, business and NGO leaders, international and research organizations, universities, and the media.

“More than ever, we need an institution like Peterson. We need a lively intellectual debate and pragmatic solutions for the key issues facing the global economy.”

"It has been a turbulent few years for the trade policy community. Throughout it all, the top-notch experts at Peterson have provided fact-based, data-driven, and historically informed analysis to help us make sense of what's going on and better understand what is at stake for people's economic prospects, both within the United States and around the world. They are fearless, and that's what I like. They don't pander to anyone. They just tell it the way it is."

“Thank you for the work your colleagues do at Peterson, the rigor of the research on tariffs is extremely important and needed at this moment. I'm grateful.”

Subscribe to the PIIE Insider Weekly Newsletter

Letter from the President

The Peterson Institute for International Economics navigated another year of technological, economic, and social turbulence in 2024. As always, we confronted the challenge of helping policymakers, scholars, and the public understand the costs and benefits of a global economy beset by rising conflicts. More than ever, the Institute must continue to take the lead in advocating greater international cooperation, not less, to address common issues like trade, climate change, industrial policies, pandemics, fiscal pressures, and aging populations. Deliberations about how to do so require evidence-based, nonpartisan, and independent analysis, as well as practical solutions from a respected source. We will continue to fulfil that role in the year ahead.

The Institute informs the world’s important economic policy debates through rigorous, intellectually open, and nonpartisan research. We strive to identify and offer workable proposals to improve human welfare. We share our research and analysis through scholarly papers and commentary, convening high-level meetings and reaching thought leaders, business organizations, educators, and policymakers. And we are expanding our impact by employing new outreach tools and approaches to engage broader audiences.

In this spirit, I am proud to present the Peterson Institute’s annual review of our scholars’ work and our public outreach.

The Peterson Institute made significant contributions on numerous critical policy issues in 2024, including:

- Threats to the global trading system and economic cooperation in general from leaders and political candidates in the United States, Europe, Latin America, India, and elsewhere advocating tariffs, industrial subsidies, export controls, and abandonment of the World Trade Organization.

- The economic impact of immigration and potential restrictions and deportations.

- Monetary and fiscal policies to combat inflation and unemployment while promoting economic growth in the United States, Europe, and other economies.

- China’s economic challenges and nationalist policies, such as its slowing growth, property bust, industrial overcapacity, deflation, urbanization, stimulus efforts, and its rising tensions with the United States and Europe.

- The growing intersection of economic and national security policies such as sanctions, export controls, and industrial subsidies in the United States, China, and other countries. The expanding role of sanctions and larger national security concerns affecting economic diplomacy by the United States, China, and other countries.

- The economic challenges posed by combating climate change, including the transition from fossil fuels to green technology, the shift to electric vehicles, energy security, decarbonization, and access to rare minerals.

- Challenges and opportunities faced by countries, especially in East Asia, caught in between rising tensions resulting from the US-China rivalry.

- The declining role of manufacturing in providing inclusive growth in the United States, China, and other economies.

Looking forward to the rest of 2025, we have underway a robust research agenda, continuing on these themes but also addressing:

- The global economic impacts of new barriers to trade, investment, and immigration, as well as the emergence of possible successors to the rules-based trading system.

- The reasons and economic implications of aging and shrinking populations, and the lessons from Japan’s policy responses.

- Different approaches to regulating artificial intelligence in the United States, Europe, and elsewhere, emphasizing the cost-benefit tradeoffs, the effectiveness of current policies, and potential improvements.

- New challenges and opportunities in combating climate change, such as striking global agreements on carbon pricing, and the impact of climate-related policies on workers and capital.

- Ways to put US fiscal policy on a sustainable path as Washington faces the economic implications of impending tax and spending changes.

- Latin American economic policies, including the struggles of Mexico, Argentina, Brazil, and other economies to achieve economic growth and stability amid rising tensions over trade and migration.

- China’s economic future, including detailed analysis of rising state control of its public and private finance sectors.

- East Asian and other regional concerns, particularly South Korea’s and Japan’s economic challenges and Russia’s expansionary policies in Europe and the effect of sanctions on its economy. We will step up our examination of how countries cope with the US-China rivalry.

As always, I wish to express our gratitude to our stakeholders and supporters—including philanthropic individuals, private-sector corporations, foundations, and government institutions—without whom we simply could not do our work. Your support allows us to speak freely and go where the research takes us. We hope to broaden support for our mission to maintain and improve global economic integration to lasting human benefit.

Sincerely,

Adam S. Posen

President | Peterson Institute for International Economics

Key Areas of Impact

Elections 2024: Assessing economic platforms in the United States and worldwide

Trumponomics. In a top PIIE publication of the year, Warwick J. McKibbin, Megan Hogan, and Marcus Noland modelled the impact of Donald Trump’s proposed deportations, tariffs, and plans for the Federal Reserve on the US and 24 other economies, receiving more than 2,000 news citations, including featured coverage in the New York Times and CNN, and an Associated Press article published by over 500 local affiliates.

Adam S. Posen’s story in Foreign Affairs argued that Trump’s economic agenda and threats would increase uncertainty, inflicting damage to the US that would be difficult to reverse. Following the election, Olivier Blanchard explained in a top PIIE post why the consequences of Trump’s policies might be disappointing but wouldn’t be the catastrophe some economists claim, as long as the Federal Reserve sticks to its mandate to safeguard against inflation.

Costs of tariffs. In another top PIIE publication, Kimberly Clausing and Mary E. Lovely found that Trump's proposed tariffs, combined with his tax cut proposals, would hurt low-income and working-class Americans the most, costing $1,700 a year for a typical middle-income household (an estimate later revised to $2,600 under higher tariffs). The research received over 2,500 media citations across print, radio, and national/local television in 35 countries and was used extensively in fact checking articles following the June presidential candidates’ debate and Republican convention. In November, Lovely was invited by the Port of Los Angeles to discuss tariffs and global trade for its media call.

Trump’s threatened tariffs on China, Mexico, and Canada would hit a broad array of goods on which consumers and industry depend, including fruits and vegetables, electronics, fuels, and more, based on analysis by Julieta Contreras, Mary E. Lovely, and Jing Yan. Their research was featured in an exclusive by CNN.

Mass deportations. Two resources by Megan Hogan listing major immigration policies and proposals by President Joseph R. Biden, Vice President Kamala Harris, and candidate Trump were PIIE’s most viewed pieces of the year. Michael Clemens and Warwick McKibbin spoke at PIIE about the possible damage to the US economy caused by migration restrictions. Clemens’s blog and talk helped propel him as a go-to expert on immigration during the campaign season, with citations across top tier news outlets such as the Financial Times and The Atlantic. In November, Clemens was the guest on The Economics Show podcast to discuss what a second Trump administration means for immigration.

Permanent Normal Trade Relations (PNTR). Concerns over Chinese trade practices and the economic impact of surging Chinese exports, together with security and political developments have fueled bipartisan interest in revoking China’s PNTR status granted in 2000. Marcus Noland and Warwick McKibbin argued that this move would result in higher prices and lower economic output in the United States than otherwise, particularly in agriculture and manufacturing. Their findings were cited by Bloomberg News, Foreign Policy, and Forbes.

Income taxes and tariffs. In PIIE’s fourth most read publication, Kimberly Clausing and Maurice Obstfeld explained that tariffs would not yield sufficient revenues to replace income taxes and that relying on tariffs instead of income taxes would be regressive and economically harmful. Their research was cited in the Financial Times and shared on X by the House of Representatives Ways and Means Committee Democrats. Clausing gave an interview more recently with NBC. In another popular post, Clausing and Obstfeld argued that Trump's proposed comprehensive tariffs are not economically defensible.

Bidenomics. The Washington Post Editorial Board cited research by Gary Clyde Hufbauer showing how “Buy American” provisions such as those in Biden’s CHIPS Act and Inflation Reduction Act drive up costs to taxpayers, while the Wall Street Journal Editorial Board cited earlier research by Hufbauer on how each job “saved” by Trump’s steel tariffs in his first administration cost consumers and businesses more than $900,000.

Explaining tariffs. Douglas A. Irwin made appearances on CBS Sunday Morning and the Wall Street Journal to explain how tariffs work and why American consumers would end up paying for them. Richard Baldwin shared weekly explainers on why tariffs would not reduce the US trade deficit and other trade misconceptions to his 15,000 LinkedIn followers. Gary Clyde Hufbauer’s op-ed in The International Economy outlined how trade has contributed massive gains to the US economy since World War II. In the East-Asia Forum, he argued Trump’s agenda trades US global leadership for tariffs. Olivier Jeanne examined the extent to which tariffs can be offset by exchange rates in a publication for the Journal of International Money and Finance.

Fed independence and inflation. In an op-ed for Project Syndicate, Maurice Obstfeld warned that policy proposals attributed to Trump’s economic advisers would revive 1970s-era inflation and jeopardize Fed independence. He also argued that limits to Fed independence, tax cuts, and lightly regulated cryptocurrencies threaten US price stability and would potentially fuel inflation. David Wilcox warned that a second Trump term could mean massive changes to the Fed, reverting to a bygone era of political control of monetary policy.

Supply chains. Julieta Contreras showed that curbs on imports of Mexican vehicles and parts would harm the US auto sector. Yeo Han-koo, in a Nikkei Asia webinar, discussed the dangers of Trump policies on semiconductor and tech supply chains—the webinar recorded the highest views among the series.

European elections. Analyzing the EU elections in June 2024, Cecilia Malmström cited how myriad issues, such as EU farmer protests and the rise of far right parties in the European parliament, mean a future of political uncertainty on the continent. The election of a new UK prime minister, Keir Starmer, portends a new model in EU-UK relations, she wrote. Anna Stansbury and coauthors examined economic inequality in the UK prior to the elections in a PIIE working paper and later in papers that were part of a project at the Harvard Kennedy School.

Indian elections. Arvind Subramanian commented extensively on economic and other issues ahead of the elections. In the Business Standard, he explained that India’s exchange rate policy shifts could affect its export performance and economic growth. In Foreign Policy, Subramanian outlined the path for India to follow in promoting manufacturing, citing the policies he has advised in the southern state of Tamil Nadu as an example, a theme echoed in an op-ed for the Financial Times.

Latin American elections. Following a series of elections in Latin America, PIIE hosted an event with fellows Monica de Bolle, José De Gregorio, and Alejandro Werner on the policy challenges posed by inflation risks and weak financial systems. Werner noted that remittances and tight monetary policy have kept the Mexican peso strong. Following the election of Mexican president Claudia Sheinbaum, Werner assessed her challenges in sustaining the policies of her powerful predecessor, Andres Manuel Lopez Obrador. Werner joined two events at the Georgetown Americas Institute on the state of democracy in the Americas and how Mexico is addressing economic challenges.

Election education. Cullen S. Hendrix joined ABC News’ 538 Politics podcast to talk about how the state of the economy influences elections.

Mary E. Lovely contributed to the national debate over tariffs and export controls, appearing on major broadcast news outlets including CNN, PBS NewsHour, CNBC, and CBS' 60 Minutes (in 2025). Above, she outlines Trump’s vs. Biden’s trade strategies with China and how they could affect US consumers in a Wall Street Journal video that earned over 350,000 views.

Olivier Blanchard joined the new PIIE Insider LIVE series to break down some of President-elect Trump's economic policies. The full video has garnered over 5,600 views.

Douglas A. Irwin joined CBS Sunday Morning to discuss the history of US tariff usage, how they work, why they’re used, and how President Trump’s tariffs could impact American consumers.

The Wall Street Journal cited Gary Clyde Hufbauer's 2018 research on the cost of steel tariffs.

Protectionist measures against Mexico's auto industry would likely harm US firms, due to the levels of US-made content embedded in Mexican exports to the US, Julieta Contreras finds in a blog.

Listen here or wherever you get podcasts to Cullen S. Hendrix explaining voters' relationships with the economy, how and why partisanship matters in shaping perceptions, and more.

The future of trade and the world trading system

Several PIIE experts were on the opening panel of the WTO Public Forum in September where Director-General Ngozi Okonjo-Iweala gave opening remarks. PIIE also hosted Okonjo-Iweala at an event in April, which drew media coverage from Reuters, Bloomberg, and Barrons.

America must move beyond a limited, domestic view of national security and adopt a broader and more holistic view of collective national security with allies, Yeo Han-koo wrote in March.

World Trade Organization. The WTO Public Forum in Geneva in September featured several PIIE experts in its opening panel on the future of trade, which featured remarks by WTO director-general Ngozi Okonjo-Iweala. Anabel González, Cecilia Malmström, Mari Pangestu, and Adam S. Posen joined former director-general Yi Xiaozhun on the panel, which Richard Baldwin moderated for 800 in-person attendees. Also in Geneva, Alan Wm. Wolff outlined ways that trade and economic reforms could contribute to stability in Somalia and other war-torn countries. He addressed the WTO Ministerial meeting in Abu Dhabi in April 2024. Wolff wrote regularly on the role of the world trading system, including a paper on how the WTO could still be relevant amid rising populism and geopolitical tensions.

National security. Yeo Han-koo warned against using national security justifications to threaten US allies with tariffs, blocking investment, and other economic tools, arguing that such actions weaken US national security and damage US competitiveness in trade. Martin Chorzempa, in the same vein, explained that blocking the Nippon Steel acquisition of US Steel could jeopardize the independence of the Committee on Foreign Investment in the United States (CFIUS) in deciding national security threats in the future. Jeffrey J. Schott, in a report published by the Italian Institute for International Political Studies, asserted that intermingling economic security and national security threatens world trading systems.

USMCA. Jeffrey J. Schott testified at a hearing by the US International Trade Commission in October to discuss concerns posed by the auto rules of origin provisions of the US-Mexico-Canada Agreement (USMCA).

Agriculture. PIIE cohosted an event in May with the International Food Policy Research Institute on policies to help developing countries dependent on agriculture exports, featuring former WTO director-general Pascal Lamy. The event had over 1,100 attendees (including virtual). Anabel González (on public service leave), Mary E. Lovely, and Mari Elka Pangestu joined the panel and Sherman Robinson helped organize

Globalization. Adam S. Posen advised the International Monetary Fund in its Finance & Development magazine to prepare for the corrosion of globalization. In an Asian Economic Policy Review paper, Richard Baldwin and coauthors contended that rapid globalization has not ended but rather has evolved with the rise of services trade.

De minimis. As legislators consider altering or eliminating the trade exemption that allows low-value shipments to enter the US duty-free, Mary E. Lovely and Gary Clyde Hufbauer organized a discussion on what would happen.

In-depth analysis on the US economy

Semiconductors and technology. Martin Chorzempa garnered over 1.3 million views on social media posts featuring his work on the CHIPS Act, in which he explained that the Act has spurred investment while threatening a subsidy war with South Korea. His data were cited by the Financial Times and Bloomberg. In an op-ed for Barron’s, Cullen S. Hendrix explained that diversifying foreign graphite sources can boost production of American-made batteries complicated by supply chain risks.

US taxes. Kimberly Clausing testified twice before influential tax policy committees in Congress, urging that looming US fiscal challenges be met with tax reform that is fairer to the middle class, addresses climate change, and discourages corporations from relocating to offshore low-tax havens. She wrote in the Financial Times that updating US tax policy would help more with offshoring than tariffs. In 2024, Clausing was named the 5th most cited professor in tax law in the past five years and 9th all-time and joined Chris Hayes’ Why Is This Happening? podcast to discuss the stakes of tax policy.

Resiliency. In February, Adam S. Posen was interviewed by the Financial Times on lessons learned from the pandemic, the rise and recent fall of inflation, the future of US productivity, and factors dragging down China's economy.

Trade deficit. Maurice Obstfeld challenged the widespread but fallacious view that US trade deficits result from actions by foreign countries. Mary E. Lovely joined Bloomberg’s Wall Street Week to explain that trade deficits can be good or bad depending on what the cause is.

Immigration. Michael A. Clemens did much to debunk myths surrounding immigration, analyzing barriers against high-skilled immigrants to the United States and briefing White House, State Department, and Congressional Budget Office officials. Clemens also calculated that expanding lawful channels for immigration at the US southwestern border causes a net reduction in unlawful crossings.

Forecasts. PIIE’s flagship semiannual Global Economic Prospects events, led by Karen Dynan, featured Martin Chorzempa, Tianlei Huang, and Maurice Obstfeld in April, and Chorzempa, Obstfeld, and Alejandro Werner in October projecting growth despite lingering inflation concerns. Their presentations were cited by Reuters, Politico, Associated Press, and Market Watch.

Labor standards and wages. Anna Stansbury called for higher penalties and greater enforcement of the US Fair Labor Standards Act in VoxEU, citing historical data that US firms have failed to comply with minimum wage standards. Her paper suggesting compliance incentives was published in the ILR Review. The Hill published an op-ed by Stansbury highlighting why CEOs should want better enforcement of labor laws. She was featured on the Pitchfork Economics podcast and on the Financial Times’ The Economics Show podcast.

Regulations. The Supreme Court’s decision overturning the 40-year-old Chevron doctrine could pave the way for weaker regulations, argued Alan Wm. Wolff in a blog.

The dismal science. Jason Furman, delivering the second annual Richard N. Cooper lecture, entitled "In Defense of the Dismal Science," called for recognition of the importance of tradeoffs in economic policymaking. Furman also continued writing his monthly Wall Street Journal column.

Chorzempa’s data on US chip construction after the CHIPS Act made the rounds online, including an earlier version of the chart in a viral post on X.

Kimberly Clausing testified before the US Senate Joint Economic Committee hearing on "The Fiscal Situation of the United States."

Assessing the economics of climate change and the green transition

Monica de Bolle’s new podcast, Policy for the Planet, examines how countries are responding to the climate crisis. Mary E. Lovely joined the top episode of the first season to discuss how the auto industry is changing and what it will take to get more people to switch to electric vehicles, especially in the United States.

Senator Sheldon Whitehouse (D-RI) shares praise for Kimberly Clausing's op-ed.

Policy for the Planet. Launched in October, Policy for the Planet is a biweekly podcast hosted by Monica de Bolle, featuring economists, health and science experts, and political scientists enlisted to guide policymakers dealing with climate change. Their topics ranged from public health to artificial intelligence, electric vehicles, and natural gas exports. The first season featured Jean Pisani-Ferry, Michael A. Clemens, Mary E. Lovely, Cullen S. Hendrix, Jacob Funk Kirkegaard, and Kimberly Clausing from PIIE and also external experts like Daniel Yergin (S&P Global), Mary Hayden (University of Colorado, Colorado Springs), and Joanna Lewis (Georgetown University).

Critical minerals. Cullen S. Hendrix’s work on security challenges facing the critical minerals sector, especially nickel, was cited in The Economist and featured on WBUR’s On Point and the Canadian Global Affairs Institute’s Energy Security Cubed podcast. He wrote about the role of East Africa in US efforts to diversify graphite supply chains away from China and China’s export controls. In an op-ed for The Diplomat, he wrote that placing Indonesian nickel on the US list of goods produced by child or forced labor could backfire, encouraging countries with lax human rights standards to import Indonesian nickel in the US’s place.

Electric vehicles. Jacob Funk Kirkegaard argued that Europe would be more cautious than the Biden administration in raising tariffs on Chinese electric vehicles, outlining Europe’s willingness to maintain relations with China.

Carbon pricing. Kimberly Clausing detailed ways that tax policy could help with climate efforts across her work. She wrote an op-ed on carbon taxes for The Hill that was cited by Senator Sheldon Whitehouse on X, spoke at several events, including a popular PIIE-IMF conference that drew over 100 attendees in person and nearly 1,500 online, and was a guest on PIIE’s Policy for the Planet podcast. She also organized a multi-country convening on carbon border adjustments, funded by the Gates Foundation, in Pretoria, South Africa.

Deforestation. The Panama Canal is suffering a historically severe drought, caused in part by deforestation of the Amazon rainforest, endangering a major global trade route, Monica de Bolle argued in a blog post that was shared by the head of the European Central Bank’s Climate Change Centre, Irene Heemskerk.

UK decarbonization. Steven Fries helped develop the Seventh Carbon Budget recommendation from the UK Climate Change Committee (CCC) to Parliament and the British government, covering 2038-42, and also helped produce the CCC’s annual report to Parliament on reducing emissions. He spoke about decarbonization at multiple venues, including a research seminar at Oxford University and a roundtable discussion at the CCC on the macroeconomic and competitive impacts of the net zero transition.

Artificial intelligence (AI). Companies aren’t fully transparent about AI’s “alarming” environmental impacts, but the carbon footprint of training a large language model could be equivalent to 626,000 pounds of carbon dioxide, Monica de Bolle warned.

El Niño. Research links El Niño weather patterns to natural disasters, rising food prices, and slower economic growth, leading to political instability and armed conflict within countries, Cullen S. Hendrix argued.

Understanding China’s economy and analyzing US-China relations

Adam S. Posen explains to German broadcast service DW how China is suffering from what he calls “economic long COVID” in a video that has received over 1 million views.

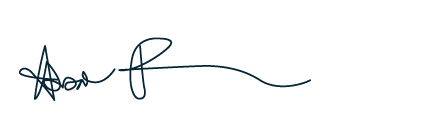

Mary E. Lovely and Jing Yan visualize where the United States, European Union, and China have shifted their sourcing of imports in this PIIE Chart.

Mary E. Lovely and Jing Yan visualize where the United States, European Union, and China have shifted their sourcing of imports in this PIIE Chart.

Nicholas R. Lardy wrote in Foreign Affairs in April that although China faces several headwinds and its growth has slowed in recent years, China is likely to expand at twice the rate of the United States in the years ahead.

China’s economic slowdown: Tianlei Huang concluded in one of the most-read pieces of the year that China’s stimulus measures may fall short of their goals. He also drew lessons from China’s fiscal policy during COVID-19 and cowrote for the Australian Institute of International Affairs that accelerating capital flight from China is a sign of changing geopolitical and economic realities in the country. He and Mary E. Lovely outlined China’s misguided economic policies for the Milken Institute Review.

China’s Communist Party (CCP): Adam S. Posen was featured in a DW News Beyond Business video with nearly a million views explaining how the CCP’s increased authoritarianism has compromised economic development. Huang and Yeling Tan wrote that the CCP’s third plenary session in July was unlikely to reverse China’s economic troubles. A joint event with Princeton SPIA featured Martin Chorzempa and Tan discussing the sustainability of China’s Communist Party-controlled economic model.

Decoupling trade: Mary E. Lovely and Jing Yan analyzed trade data showing that as the US has reduced reliance on imports from China since 2018, the European Union and China have deepened trade dependencies, a finding cited by Reuters. When Biden imposed tariffs on China in May, Yeling Tan wrote that Beijing’s response could be gleaned from the first Trump administration, namely, a deeper turn toward protectionism and diversification of its trade away from the United States. Cecilia Malmström hosted a Trade Winds episode with Lovely in November focusing on the future of US-China trade after the US election. Arvind Subramanian wrote in Project Syndicate that Western countries retaliating against China for its supposed exporting of excess capacity reflects a misunderstanding of the resilience of the Chinese export juggernaut.

Export controls and sanctions. Martin Chorzempa, Mary E. Lovely, and Yuting (Christine) Wan developed an important dataset revealing the rise of US export controls and economic sanctions on China by the first Trump administration and under Biden, driven by national security and human rights concerns. The paper was cited by Bloomberg and the New York Times. Chorzempa amplified concerns that these actions need to be coupled with steps to better manage that relationship in a CSIS report and also wrote about export controls for the Penn Project on the Future of US-China Relations.

Property crisis. Tianlei Huang commented in ThinkChina, a Singapore-based publication, that China’s efforts to reverse the property crisis are likely to fall short, as he previously suggested in his 2023 Working Paper, which was cited multiple times in the US-China Economic and Security Review Commission’s 2024 annual report. Nicholas R. Lardy wrote residential property completions in 2023 outstripped the pace of new residential starts for the first time.

Underestimating China. Nicholas R. Lardy cautioned in Foreign Affairs that while China’s growth has slowed in recent years, its economy is likely to expand at twice the rate of the United States in the years ahead. The piece was widely shared across Chinese language media. Lardy also produced two PIIE Charts indicating that China's real GDP continues to grow faster than that of the United States and household consumption is not as low as many think. In April, Lardy joined CNBC to discuss US Secretary of State Antony Blinken’s visit to China.

US stance on China. In a Financial Times podcast, Adam S. Posen made the case for a less confrontational US stance towards China, criticizing the Biden and Trump administrations for policy errors regarding manufacturing, unilateralism, and self-sufficiency.

Private sector trends. Tianlei Huang and Nicolas Véron’s tracker on the share of China’s state vs. private sector among the country’s largest listed companies found a small uptick in the private sector in the second half of 2024 after years of decline. The tracker was cited by The Economist.

Population decline. In one of PIIE’s most popular posts of the year, Jacob Funk Kirkegaard showed how China's birth rate has dropped steeply compared to its death rate since 1985, a demographic trend that calls into question China’s long-term economic prospects.

Pharmaceuticals. Monica de Bolle explained that China’s dominant role in producing major pharmaceuticals and drugs enabled it to produce diagnostic COVID-19 tests used around the world, saving lives. She argued that barring medical products from China would hamper innovation and consumers’ access to low-cost drugs.

Our leading China Program

Tensions between the United States and China reinforced PIIE’s determination to pursue realistic policy research and independent analysis of the issues at stake. PIIE scholars continued to engage with senior officials and leading economists in China on its economic development and global relationships.

US-China competition. Mary E. Lovely testified in May to the US-China Economic and Security Review Commission that decoupling from China has been costly for US consumers and producers; she called for tariff reform to target Chinese technology-related practices.

CF40. PIIE’s longstanding relationship with China Finance 40 Forum (CF40), a leading independent think tank in China, led to six jointly sponsored Young Economist Forum seminars, co-organized by Tianlei Huang. He also co-organized the 7th PIIE-CF40 Joint China Economic Forum in Washington and coordinated meetings with visiting Chinese delegations.

Bund Summit: Several PIIE scholars travelled to Shanghai in September 2024 to attend the Bund Summit, a high-profile nongovernment financial conference organized by CF40 and China Center for International Economic Exchange, including Mary E. Lovely, Yeo Han-koo, Jeffrey J. Schott, and Mari Pangestu, while C. Fred Bergsten, Adam S. Posen, and Jason Furman joined virtually. Posen and Furman also serve on the Summit’s International Advisory Council. On the first day of the summit, PIIE cohosted a session with CF40 and the Euro 50 Group.

GEO Dialogue: PIIE is a co-organizer—along with CSIS, the Institute of World Economics and Politics at the Chinese Academy of Social Sciences (CASS), and the Shanghai Institute of International Studies—of the US-China Global Economic Order (GEO) Dialogue that takes place twice a year (once in the United States and once in China). In May, Mary E. Lovely led the PIIE delegation of Martin Chorzempa, Tianlei Huang, Adam S. Posen, and Yeling Tan at the Washington, DC event.

Mary E. Lovely testified on US trade strategy to address China's nonmarket practices.

Providing critical research on regional issues

Russia-Ukraine war. Elina Ribakova critically assessed the effectiveness of economic sanctions on Russia, testifying to the US Senate Committee on Homeland Security and Governmental Affairs Permanent Subcommittee on Investigations on how US technology was fueling the war, reprising her arguments in the Financial Times and Foreign Affairs. In June, Ribakova spoke with BBC’s Steve Rossenberg about how Russia’s war economy has been able to grow despite sanctions. Jeffrey J. Schott supported the rationale for the G7’s $50 billion loan to Ukraine backed by Russian reserves held by the West. Nicolas Véron wrote a position paper for the Round Table Discussion of the Committee on Foreign Affairs of the House of Representatives of the Netherlands on Russia’s immobilized reserves.

Asia and the United States. East Asia can avoid economic damage or even gain from Trump’s protectionist measures if the region’s countries independently pursue their interests in the US-China rivalry, Adam S. Posen wrote after the US election for the East Asia Forum. Marcus Noland wrote about how Trump’s policies would benefit other countries, including most countries in Asia, for the East-West Center.

South Korea’s turmoil. Following the short-lived declaration of martial law and subsequent political turmoil in South Korea, Yeo Han-koo assessed the economic implications in US and Korean media outlets.

South Korea series. For PIIE’s 2024 series on the Korean economy, Douglas A. Irwin and Maurice Obstfeld explored the predominantly external price factors in Korea’s long-run real exchange rate behavior; Michael Clemens recommended enhanced labor migration to deal with Korea’s economic and demographic crisis; Yeo Han-koo and Alan Wm. Wolff called on Korea to deepen its trade relations with the United States, Pacific countries, and the Global South, including by joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and “materializing” the Indo-Pacific Economic Framework (IPEF), and to strengthen institutional support for defense industrial collaboration. (See above for Martin Chorzempa’s research on semiconductors.)

North Korea. Marcus Noland warned about the demise of the United Nations’ Panel of Experts meant to monitor UN-authorized sanctions on North Korea amid evidence of the country’s deepening food insecurity.

Japan. Takeshi Tashiro wrote about Japan’s output gaps in the 1990s for the book Rethinking Japanese Economic Policy at the Turn of the 21st Century. Adam S. Posen welcomed Kazuo Ueda, governor of the Bank of Japan, for an event on changes in the bank’s monetary policy framework.

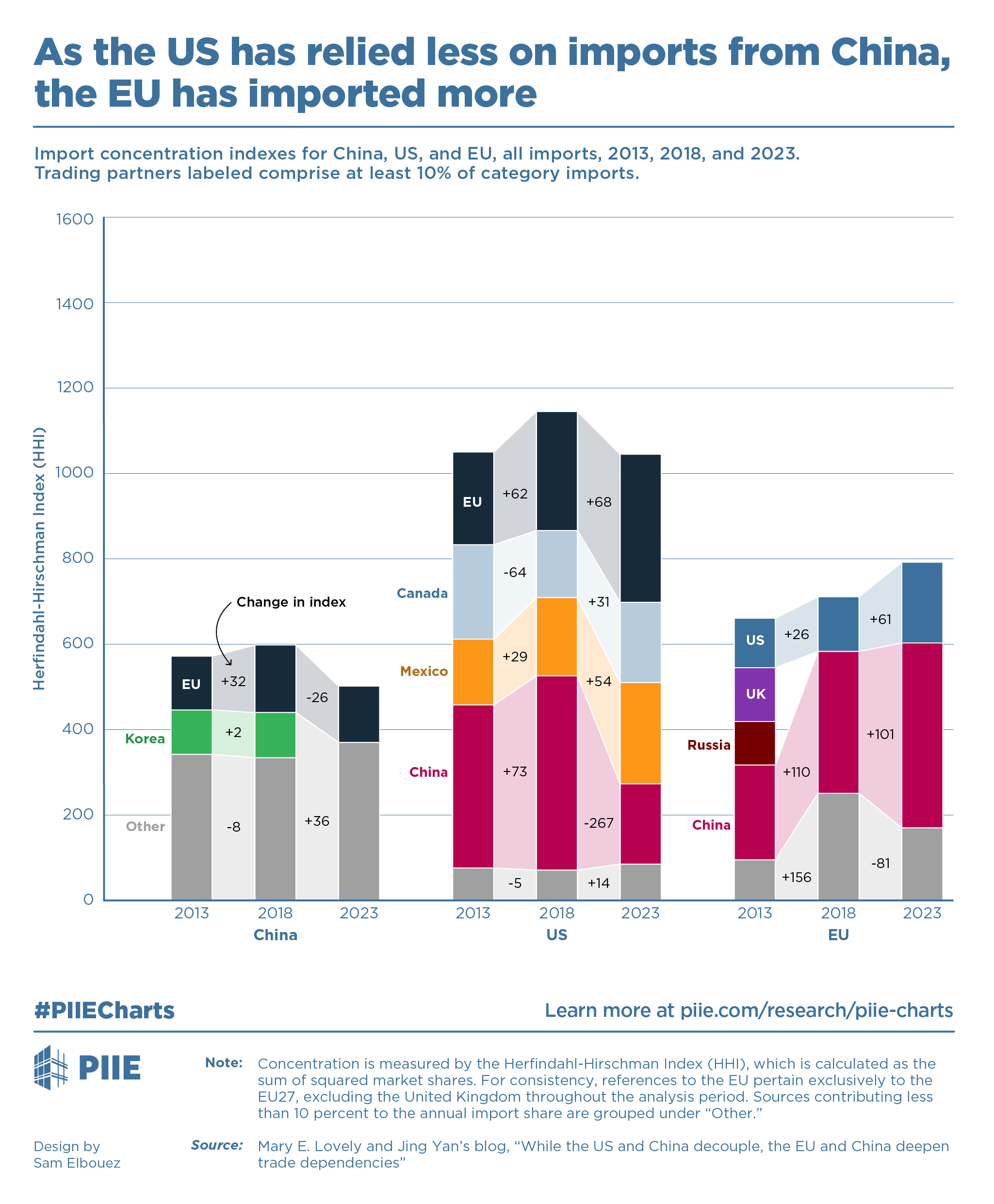

Middle East. Adnan Mazarei analyzed mounting debt issues and other factors destabilizing the Middle East, especially those leading to the collapse of the Syrian government. His Policy Brief and accompanying PIIE Chart on Egypt outlined the problems impeding its economic recovery. Sherman Robinson regularly commented on economic issues for the Middle East Broadcasting Network (MEBN).

Europe. Among the many ways PIIE scholars are engaged across Europe, Olivier Blanchard testified to the UK House of Lords Economic Affairs Committee on the sustainability of national debt and reviewed Mario Draghi’s report on the future of European competitiveness; Jacob Funk Kirkegaard wrote in Foreign Affairs about Germany’s economic reckoning; Patrick Honohan wrote op-eds about Ireland’s tax system (Irish Times) and strong recovery from the global financial crisis (Economics Observatory); Anna Stansbury analyzed binding constraints to productivity growth in the UK’s regions outside London and in the greater South East; Adam S. Posen spoke on a Bloomberg podcast about how France’s primary challenge is the underlying division in the government.

Australia. Warwick McKibbin wrote in the Australian Financial Review that Australia’s cost-of-living crisis has reached a critical juncture.

Latin America. Monica de Bolle wrote in the Financial Times that Latin America is the victim of protectionist contagion. She explained to NPR and the BBC that Elon Musk and the MAGA movement in the United States have looked to Argentina’s president Javier Milei for a model on how to make government cuts. Alejandro Werner assessed Milei’s “shock therapy” policies and explained in the Financial Times that Argentina and the International Monetary Fund should focus on growth, reform, and slowing inflation. Michael Clemens spoke at the Banco de México on the macroeconomic implications of migration.

Elina Ribakova testified to the US Senate Committee on Homeland Security and Governmental Affairs Permanent Subcommittee on Investigations on how US technology was fueling the war.

Elina Ribakova testified to the US Senate Committee on Homeland Security and Governmental Affairs Permanent Subcommittee on Investigations on how US technology was fueling the war.

Barely 24 hours after the brief imposition of martial law in South Korea, Yeo Han-koo spoke on Bloomberg Businessweek about his views and implications for the economy. He updated these views in a 2025 PIIE Insider LIVE episode.

A fixed or highly stabilized exchange rate has not served Egypt well, Adnan Mazarei wrote. Egypt needs to break free from its recurring crises by undertaking major reforms and relying less on the military in its economy and foreign financial inflows.

A fixed or highly stabilized exchange rate has not served Egypt well, Adnan Mazarei wrote. Egypt needs to break free from its recurring crises by undertaking major reforms and relying less on the military in its economy and foreign financial inflows.

Tackling financial and monetary policy challenges

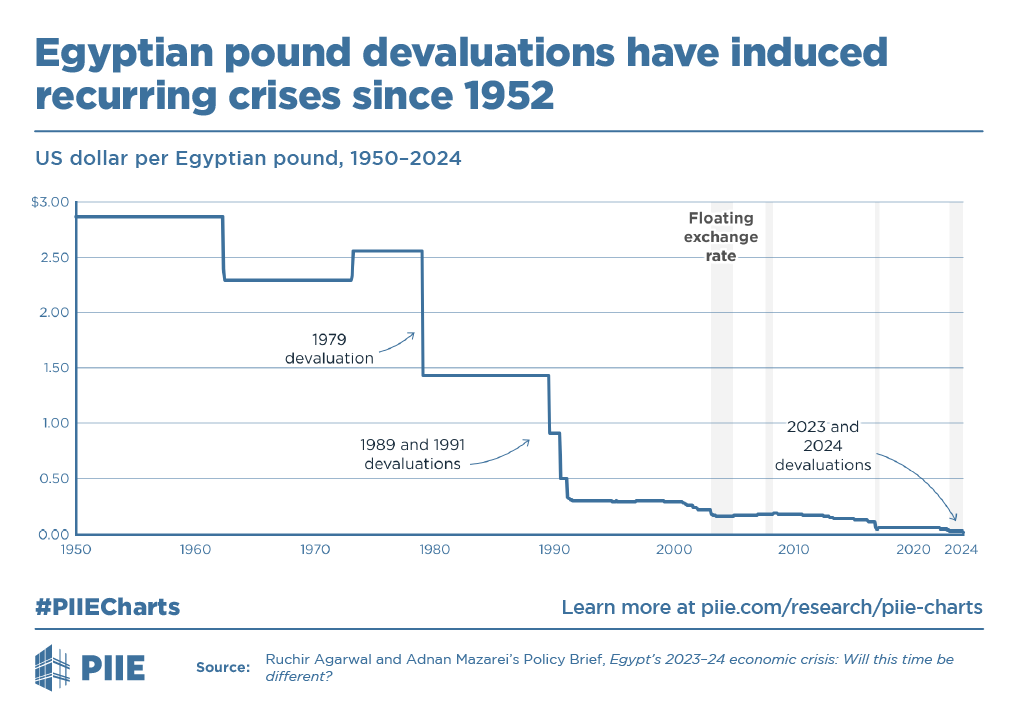

Olivier Blanchard and Ben S. Bernanke’s findings further illustrated previous research on how strong price shocks, particularly in energy and food, help to explain most of the increase and later decrease in the recent inflation in the US and euro area.

Olivier Blanchard and Ben S. Bernanke’s findings further illustrated previous research on how strong price shocks, particularly in energy and food, help to explain most of the increase and later decrease in the recent inflation in the US and euro area.

The Washington Post cited Gary Clyde Hufbauer, Megan Hogan, and Yilin Wang’s research suggesting trade liberalization policies would reduce inflation by about 1.3 percentage points.

Pandemic-era inflation. Olivier Blanchard and former Federal Reserve chair Ben S. Bernanke (Brookings Institution) analyzed pandemic-era inflation in 11 countries, in a collaborative project with 10 central banks, finding inflation resulted primarily from supply disruptions and sharp increases in food and energy prices. Their discussion generated substantial news coverage and was cited by Federal Reserve Bank of San Francisco president and CEO Mary C. Daly.

Karen Dynan and David Wilcox spearheaded a research project exploring monetary and fiscal policy contributions to the remarkable surge and subsequent partial retreat of inflation during and after the pandemic. The project convened internal and external authors, including Patrick Honohan on Europe, Joseph E. Gagnon and Asher Rose on G7 economies and lessons from the Korean War, and Dynan and Douglas Elmendorf on the role of fiscal policy in 2020-21. As inflation spiked in April 2024, Joseph E. Gagnon was interviewed by CNN, reporting early that while inflation was still a threat, it was receding.

Alleviating inflation. A 2022 PIIE study by Gary Clyde Hufbauer, Megan Hogan, and Yilin Wang showing that trade liberalization policies could reduce inflation by 1.3 percentage points, saving $800 per US household, was cited by Fareed Zakaria in the Washington Post.

Adam S. Posen was featured on Bloomberg Surveillance in May for his views on how inflation would fare in 2025 and the possibility of the Federal Reserve hiking interest rates. In August, Posen wrote in the Financial Times that the Federal Reserve should prepare the public for a possible tightening of monetary policy by mid-2025. Patrick Honohan explored in the Irish Times how central banks failed to keep prices stable and published a PIIE Chart on how inflation has averaged close to target since the euro was introduced.

Banking union. Nicolas Véron wrote in Politico with Bundesbank President Joachim Nagel on Europe’s banking union project and led the conversation and research on Europe’s banking and capital markets unions, testifying at and producing a report for the European Parliament.

Currency and exchange rates. Adnan Mazarei, Douglas Irwin, and Maurice Obstfeld argued that fixating on fixed exchange rates has harmed developing countries like Egypt, Nigeria, Bolivia, Lebanon, and Sri Lanka. José de Gregorio cowrote two pieces in the Journal of International Economics on currency pricing and Chilean exports, and the boom of corporate debt in emerging markets. Olivier Jeanne said that the disproportionate demand for dollar reserves originating from Asia is frequently overlooked by analysts. Alejandro Werner warned that Bolivia is at risk of a currency crisis as the government keeps a fixed exchange rate with no international reserves to support it. Monica de Bolle discussed Bolivia’s balance of payments crisis for the Wilson Center.

New and forthcoming books by PIIE scholars

Behind the Curve: Can Manufacturing Still Provide Inclusive Growth? (PIIE, August 2024) by Robert Z. Lawrence. It was included in the Financial Times list of best books of 2024: Economics.

The Central Bank as Crisis Manager (PIIE, October 2024) by Patrick Honohan.

Floating Exchange Rates at Fifty (PIIE, April 2024), edited by Douglas A. Irwin and Maurice Obstfeld. Reviewed by Foreign Affairs and called by Bloomberg’s Tom Keene a “must read.”

The Green Frontier: Assessing the Economic Implications of Climate Action (PIIE, June 2024), edited by Jean Pisani-Ferry and Adam S. Posen. The book updates and expands on research originally presented at a 2023 conference to assess costs and benefits of climate action. Reviewed in Foreign Affairs.

The New Economic Nationalism (PIIE, April 2025) by Monica de Bolle, Jeremie Cohen-Setton, and Madi Sarsenbayev.

New World New Rules: Global Cooperation in a World of Geopolitical Rivalries (Columbia University Press, January 2025) by Jean Pisani-Ferry and George Papaconstantinou.

Scholar Achievements

PIIE scholar achievements

Richard Baldwin made the Stanford/Elsevier's Top 2% Scientist Rankings.

Martin Chorzempa was awarded the Penn Project on the Future of U.S.-China Relations fellowship.

Kimberly Clausing was asked to serve on the American Economic Association’s Committee on Government Relations and as an advisory board member for the Urban/Brookings Tax Policy Center.

Michael A. Clemens was in the top 0.56 percent of all academic economists on RePEc IDEAS academic citations.

Karen Dynan was asked to join the Smith Richardson Foundation Grants Advisory Committee and was elected to be chair of the Conference on Research in Income and Wealth (CRIW). She was also a moderator at the Federal Reserve Bank of Kansas City’s 2024 Jackson Hole Symposium.

Steven Fries was appointed to the Oxford Net Zero interdisciplinary research group at Oxford University.

Cullen S. Hendrix was named to the authorial team for the 6th National Climate Assessment (NCA) and a consultant to the World Bank, working with the Macroeconomics, Trade & Investment team on issues related to critical mineral supply chains.

Douglas A. Irwin completed his term as president of the Economic History Association.

Cecilia Malmström was appointed by the Nordic Baltic Prime Ministers to a high-level advisory group helping Ukraine prepare for their EU membership; she became a member of the World Economic Forum’s (WEF) High-Level Group on Trade, a member of the World Economic Forum/European Council on Foreign Relations’ high-level group of Strategic Interdependence, and vice chair of the Migration Policy Institute’s board of trustees.

Maurice Obstfeld was appointed distinguished fellow of the American Economic Association. He is also serving as president-elect of the Western Economic Association International and as a member of California Governor Gavin Newsom's council of economic advisers.

Adam S. Posen was appointed to the Kiel Institute Scientific advisory board and to the Bank of Singapore advisory council.

Anna Stansbury received the Upjohn Institute Early Career Research Award.

Alejandro Werner was appointed to the expert panel that evaluated international cooperation at Banco de España.

David Wilcox continued to serve as chair of the Federal Economic Statistics Advisory Committee.

Yeo Han-koo was appointed as a Steering Committee member of the World Trade Organization’s “Remaking Trade for a Sustainable Future” Project and as Economic Diplomacy Advisory Committee member for the Speaker of the Korean National Assembly.

Events

Popular events on monetary policy, geopolitics, and international relations

Federal Reserve Governor Christopher Waller gave his outlook on the US economy and monetary policy, and Vice Chair Philip N. Jefferson addressed lessons learned from recent monetary policy cycles.

PIIE held a joint conference with the Bank for International Settlements (BIS) and the World Trade Organization (WTO) on the rising role of geopolitics in international trade and finance. A conference with the International Monetary Fund (IMF) explored how societies are bound to undergo massive structural changes in the context of the green energy transition, technological advances, and turbulent geopolitical relations.

PIIE board members Lawrence H. Summers and Robert B. Zoellick discussed how the incoming Trump administration should approach international economic relations.

New event series: PIIE Insider LIVE

PIIE launched a new monthly series of live chats with PIIE experts, hosted by Anjali V. Bhatt, about how they’re tackling today’s issues, their research and exclusive insights on the latest news, and implications for families and businesses. The first two episodes in November featured Olivier Blanchard on Trumponomics and Adam S. Posen on the global economy following the US presidential election. Together, they brought in nearly 1,400 attendees.

PIIE as the go-to venue

PIIE continued hosting influential policymakers, especially central bank and financial officials, economists, industry specialists, and academics, for substantive dialogue and major policy speeches.

Our events featured speakers including:

- Mohammed bin Abdullah Al-Jadaan, Saudi Arabia’s minister of finance

- Heather Boushey, chair of the White House Council of Economic Advisers

- Agustín Carstens, general manager of the Bank for International Settlements

- Shaktikanta Das, governor of the Reserve Bank of India

- Gita Gopinath, deputy managing director of the International Monetary Fund

- Joachim Nagel, president of Deutsche Bundesbank

- Roberto Campos Neto, president of the Banco Central do Brasil

- Ngozi Okonjo-Iweala, director-general of the World Trade Organization

- Changyong Rhee, governor of the Bank of Korea

- Kazuo Ueda, governor of the Bank of Japan

Note: Titles are for positions at the time of the event.

Global reach with conference and event series

The fourth annual Next STEP Global Conference in Singapore, cohosted with the Lee Kuan Yew School of Public Policy at the National University of Singapore, focused on a positive agenda to maintain the global economy amid US-China rivalry, drawing attendees across the Indo-Pacific.

Financial Statements, hosted by Nicolas Véron, drew over 3,300 attendees including policymakers from the US Congress, US Treasury, the European Commission, and many central bankers.

Trade Winds, hosted by Cecilia Malmström, drew over 3,200 attendees including government officials from the European Union, Canada, the United Kingdom, and the United States. One episode was broadcast live from the World Trade Organization’s Public Forum in Geneva.

Board of Directors

Michael A. Peterson* (Chair of the Board)

Lawrence H. Summers* (Vice Chair of the Board)

Stephen Freidheim* (Chair of the Executive Committee)

Caroline Atkinson*

C. Fred Bergsten

Mark T. Bertolini

Neeti Bhalla Johnson*

Julie Boland

Frank Brosens

Jason Cummins*

Barry Eichengreen

Roger W. Ferguson, Jr.

Peter R. Fisher*

Esther L. George

Evan G. Greenberg

Maurice R. Greenberg

Kelly Grier

Herbjorn Hansson

J. Tomilson Hill

Stephen Howe, Jr.*

Merit E. Janow

Hugh F. Johnston

Michael Klein*

Ramon Laguarta

Charles D. Lake II

David M. Leuschen

Barbara G. Novick

Tetsuo "Ted" Ogawa

Hutham S. Olayan

Peter R. Orszag

James W. Owens

Jonathan Pruzan

Paula R. Reynolds

Ginni M. Rometty

Jin Roy Ryu

Richard E. Salomon*

Dilhan Pillay Sandrasegara

Mostafa Terrab

Mark Tucker

Laura D. Tyson

D. James Umpleby III

Ronald A. Williams

Min Zhu

Robert B. Zoellick*

HONORARY DIRECTORS

George David

Stanley Fischer

Alan Greenspan

Carla A. Hills

Frank E. Loy

Jean-Claude Trichet

Ernesto Zedillo

FOUNDING CHAIR

Peter G. Peterson (1926–2018; Institute Chair 1981–2018)

*Indicates Executive Committee member

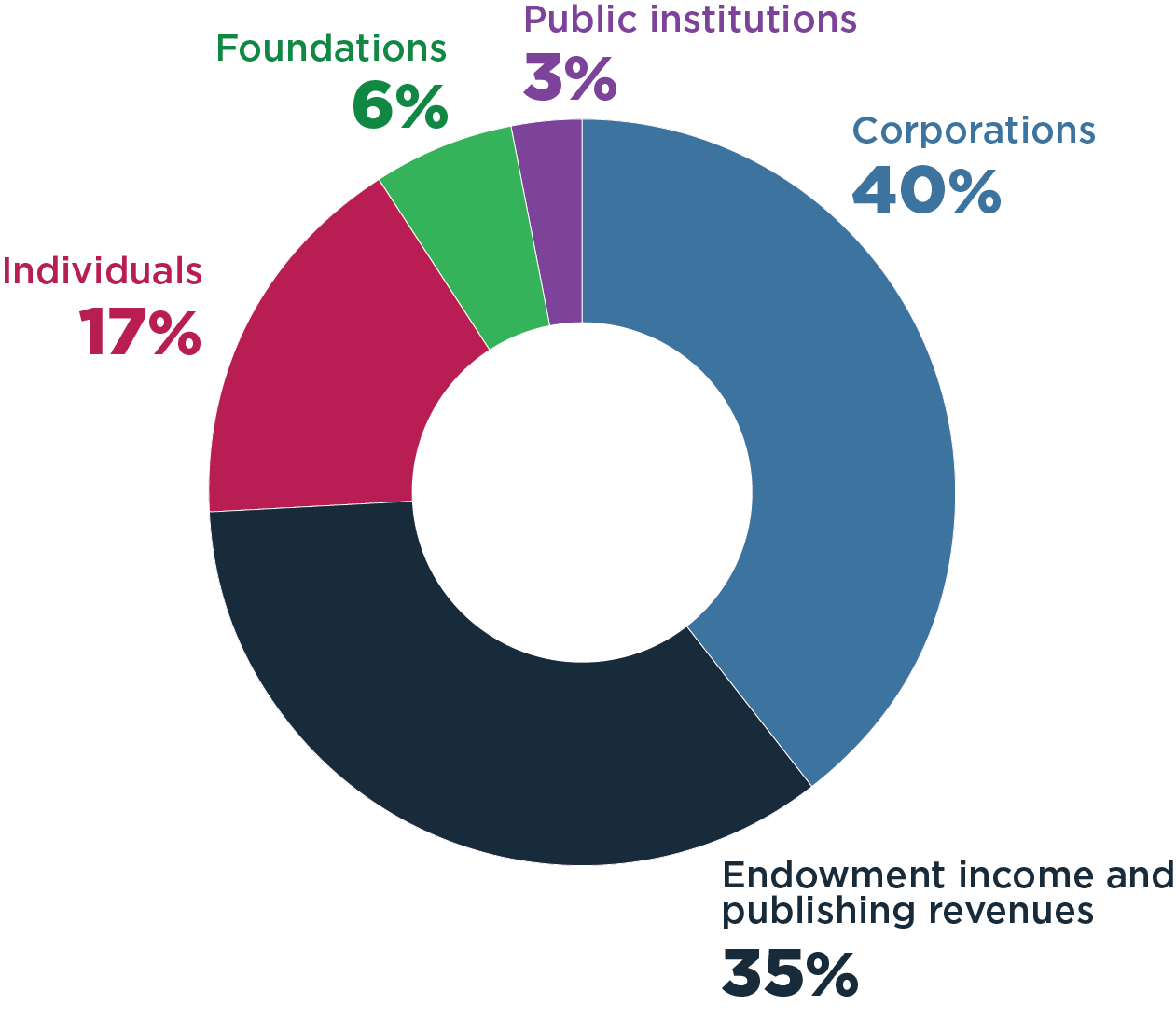

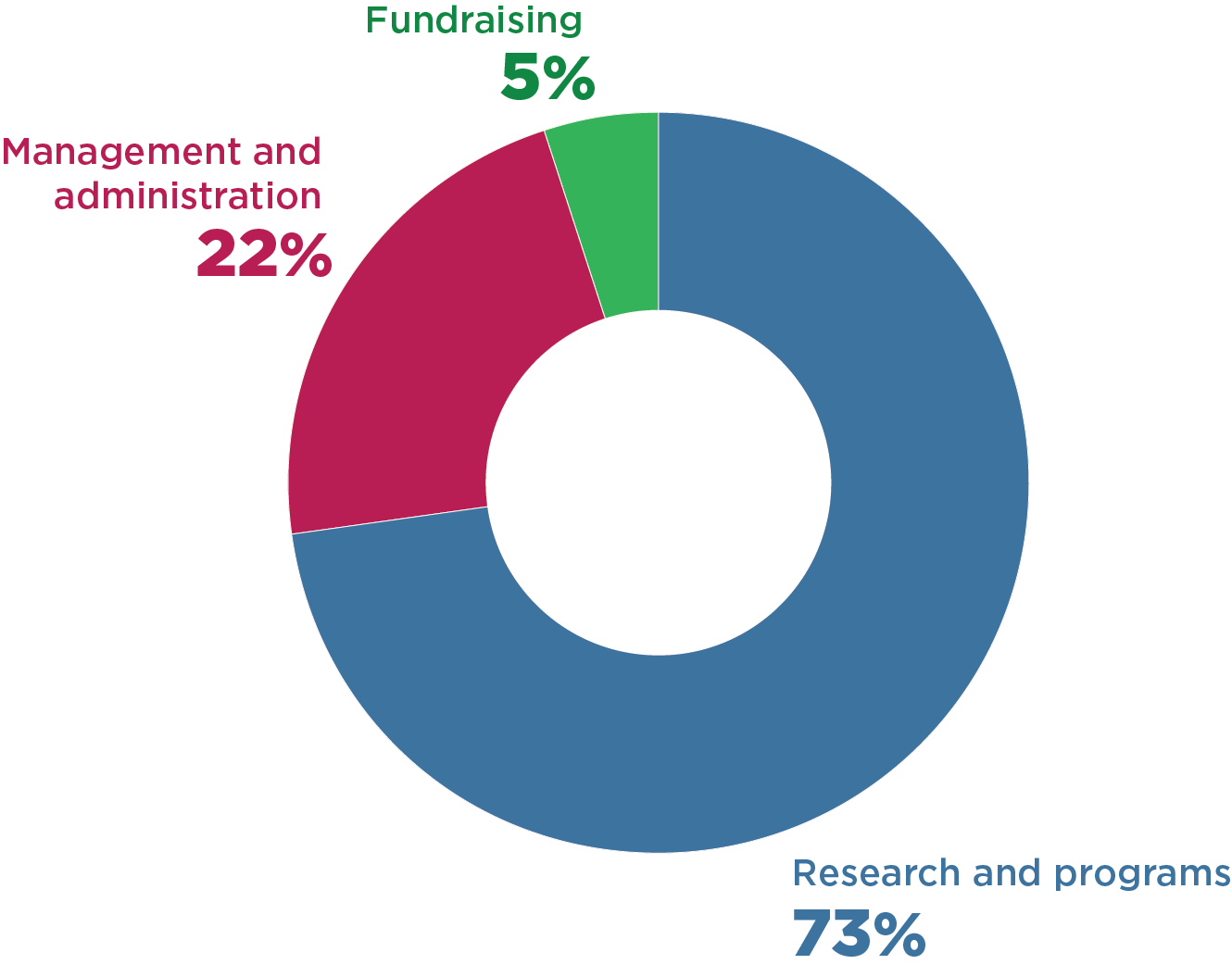

Funding

The Peterson Institute’s annual budget of $16 million is funded by donations and grants from corporations, individuals, private foundations, and public institutions, as well as income on the Institute’s endowment. The Institute discloses annually all sources of funding, and donors do not influence the conclusions of or policy implications drawn from Institute research. All research is held to strict standards of replicability and academic integrity.

Operating revenue

Operating expenses

Figures above are based on the PIIE fiscal year, July 1, 2023 - June 30, 2024.

Figures above are based on the PIIE fiscal year, July 1, 2023 - June 30, 2024.